Non-fungible tokens, or NFTs, have exploded in popularity in recent years as a way to own and trade unique digital assets. From collectible art and memorabilia to in-game items and virtual real estate, NFTs offer a new way to prove ownership and authenticity in the digital world. As with any new and rapidly evolving market, potential NFT buyers need to be informed and cautious in their purchasing decisions. In this NFT buyer’s manifesto, we’ll explore the basics of NFTs, the importance of due diligence, how to choose the right NFT and best practices for storage and security. We’ll also look at the potential future of the NFT market and offer recommendations for those looking to make long-term investments.

What are NFTs and their benefits?

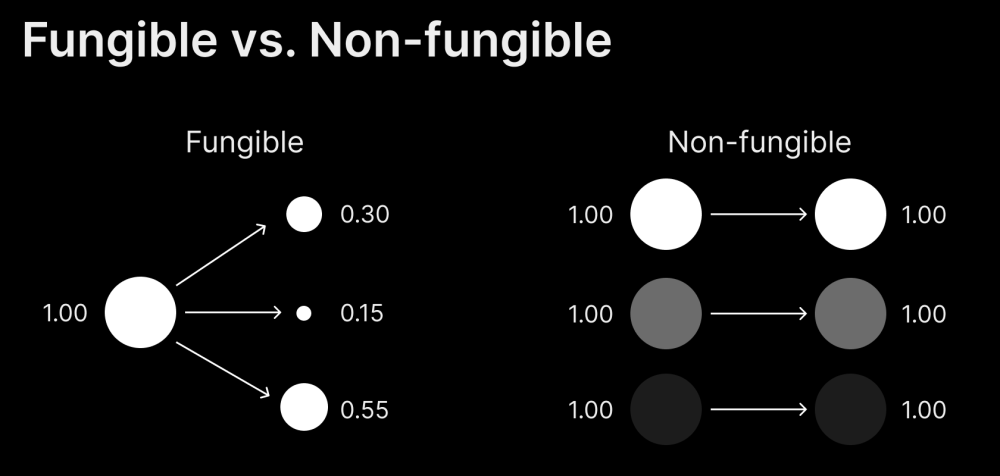

NFTs are unique digital assets that are stored on a blockchain. They are called “non-fungible” because they cannot be exchanged for other assets on a one-to-one basis like traditional currencies or commodities. Each NFT is a unique and indivisible unit, meaning it cannot be divided or replicated.

One of the main differences between NFTs and traditional digital assets is that NFTs have a verifiable ownership history and cannot be counterfeited. This makes them attractive for buying and selling rare or one-of-a-kind items, such as digital art, collectibles, and in-game items.

Another key difference is that NFTs can be easily transferred between parties, similar to how physical assets can be bought and sold. This makes them a useful tool for establishing ownership and provenance in the digital realm. There are several potential benefits to owning NFTs:

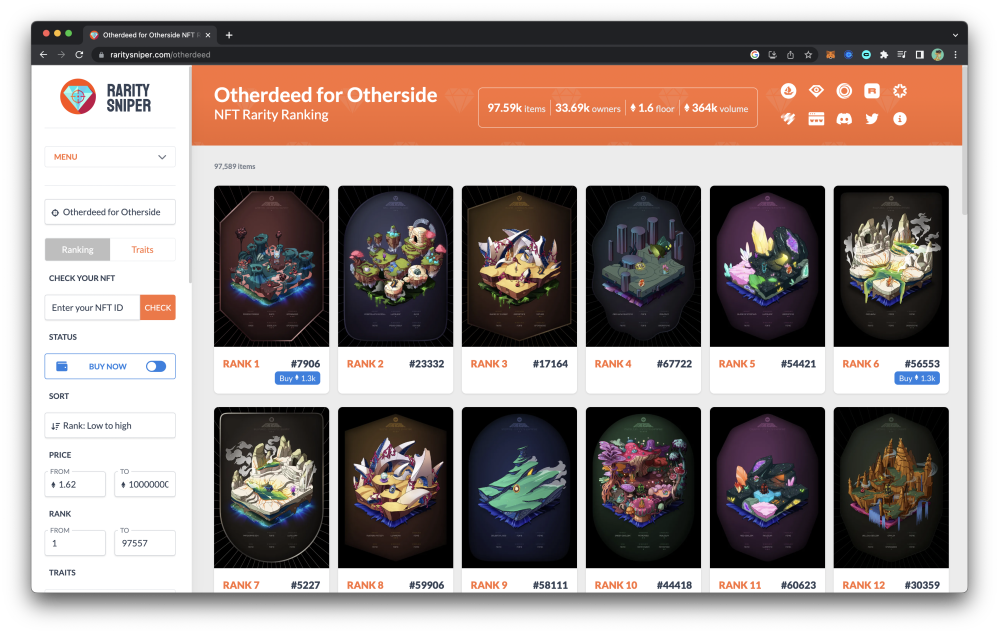

- Rarity: Many NFTs are rare and limited in number, making them valuable to collectors and investors. For example, an artist may release a limited edition series of digital art prints as NFTs, each of which is unique and cannot be replicated. Rarity Sniper is a great resource for casually looking up the rarity of NFTs.

- Uniqueness: NFTs are unique, meaning that each one is different from every other NFT. This makes them appealing to collectors who value the uniqueness and individuality of an item. One-of-one art is quickly becoming popular amongst NFT collectors.

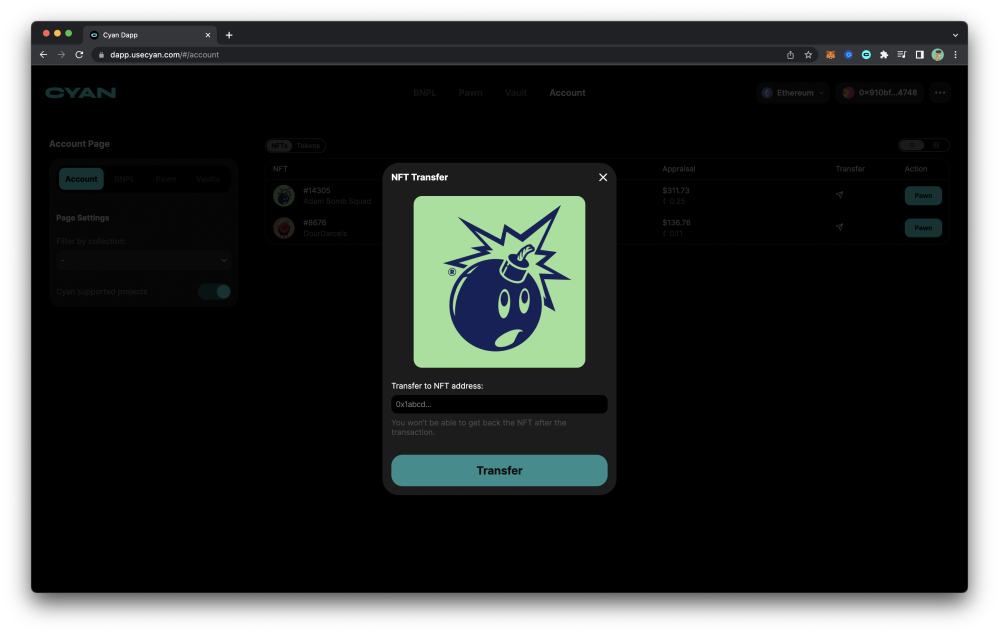

- Transfer ownership: NFTs can be easily transferred between parties, similar to how physical assets can be bought and sold. This makes them a useful tool for establishing ownership and provenance in the digital realm.

- Value: Some NFTs, such as digital art or collectibles, may increase in value over time as they become rare or in demand. This makes them a potential investment opportunity for those who believe in the long-term potential of the NFT market.

Overall, the potential benefits of owning NFTs include the ability to own and trade unique and rare digital assets, the convenience of easily transferring ownership, and the potential for increasing value.

Due Diligence

Potential NFT buyers need to conduct thorough research before making a purchase, as the NFT market is still relatively new and there are many factors to consider. The key things to research are the following:

- Authenticity: To verify the authenticity of an NFT, it’s important to research the creator and look for any associated trademarks or copyrights. You should also check the origin of the issuer and use a blockchain explorer, like Etherscan, to search for the NFT’s unique identifier on the blockchain. If possible, ask the project team for more information about the NFT and its provenance.

- Team’s reputation: Research the reputation of the team to ensure that they are trustworthy and have a good track record. Look for reviews and ask for references if possible. Also, check the team’s online presence: Do they have a website or social media profiles? Do they have a good reputation on Twitter, Discord, or OpenSea?

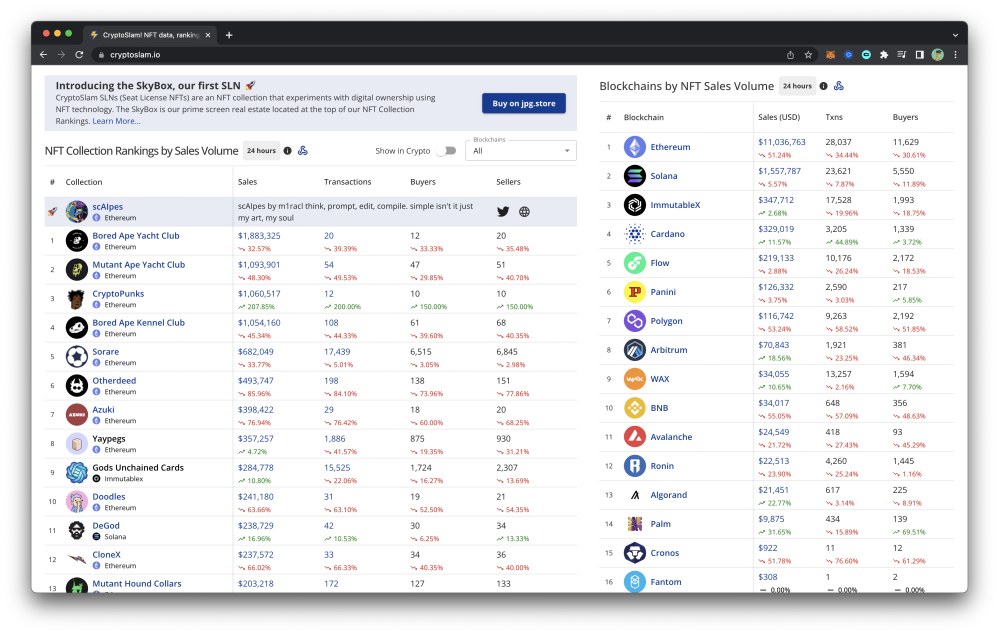

- Blockchain: Consider the blockchain technology that the NFT is built on. Some blockchain platforms are more secure and reliable than others, and the choice of platform can affect the long-term value of the NFT. Ethereum is the most popular, followed by Solana and Polygon chains. CryptoSlam is a great resource for keeping track of volumes on each chain to determine if there is enough liquidity further down the line.

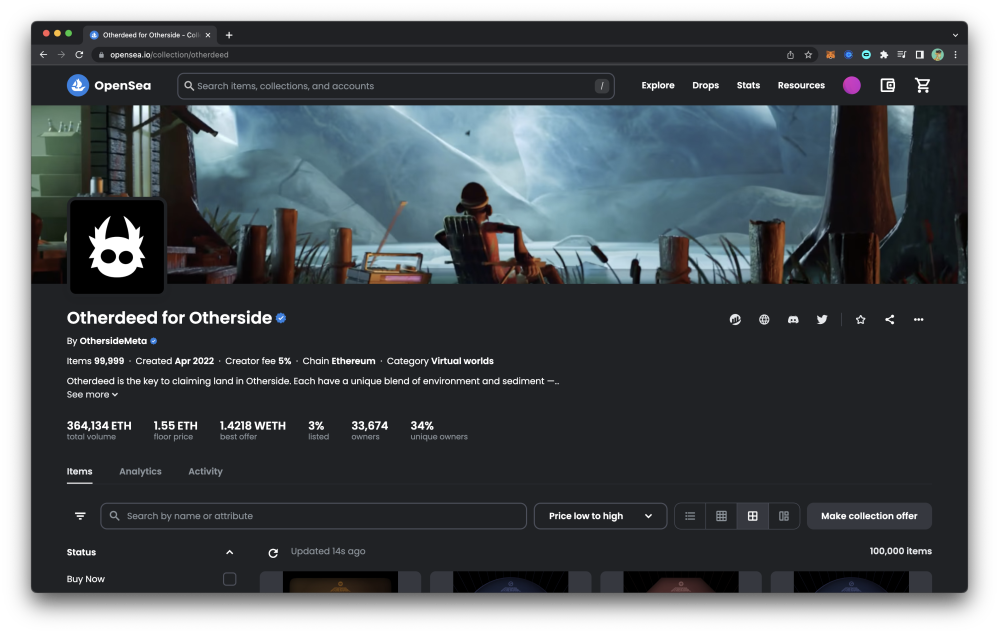

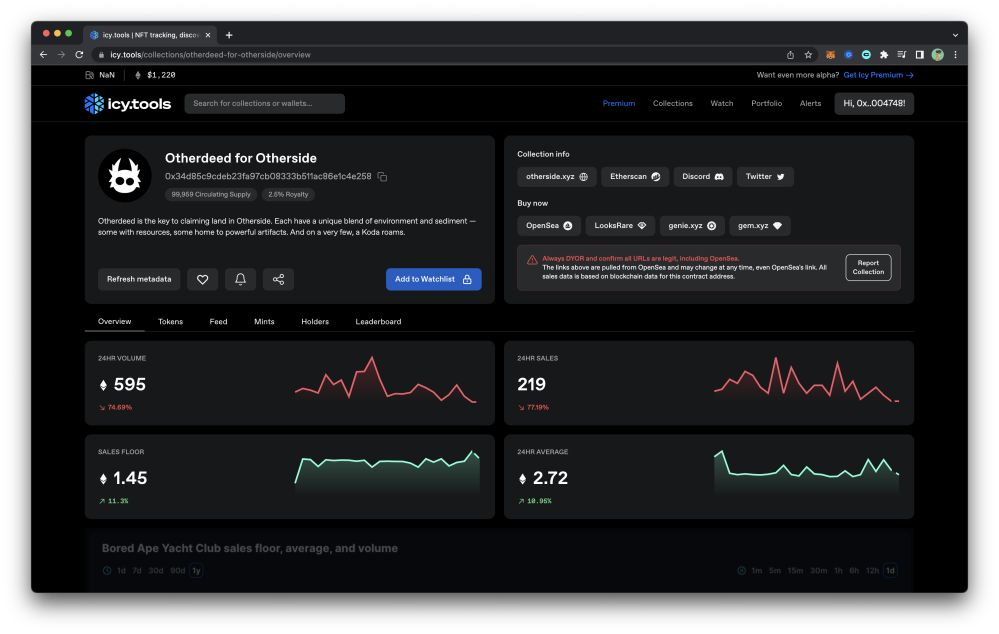

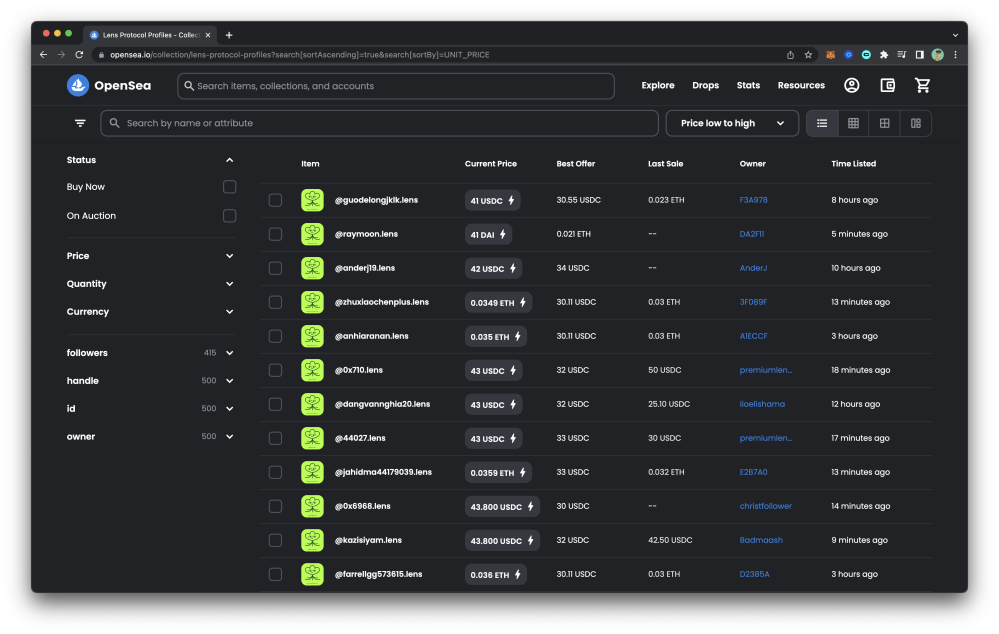

- Future value: Research the potential future value of the NFT. Look for information about the rarity and demand for similar NFTs, as well as any external factors that may affect the value of the NFT in the future. Checking the analytics of the collection on OpenSea or Icy.Tools is a great place to start basic research.

Keep in mind it’s always a good idea to conduct thorough research and exercise caution when buying any NFT, as the market is still relatively new, and not all project builders may be reputable.

Choosing the right NFT for you

NFTs come in a wide variety of types! These can include art, collectibles, in-game items, virtual real estate, and other digital assets. NFTs offer a way to own and trade unique and rare digital assets, with the added benefits of verifiable ownership and the ability to easily transfer ownership. Potential buyers should research the specific type of NFT they are interested in and understand what they are buying.

- Art: Digital art is one of the most popular categories of NFTs. This can include anything from digital paintings and illustrations to 3D models and animations. Many artists are using NFTs as a way to sell their work and establish ownership and provenance.

- Collectibles: NFTs can also be used to represent physical collectibles, such as trading cards, stamps, or coins. These NFTs can be used to prove ownership and authenticity of the physical item.

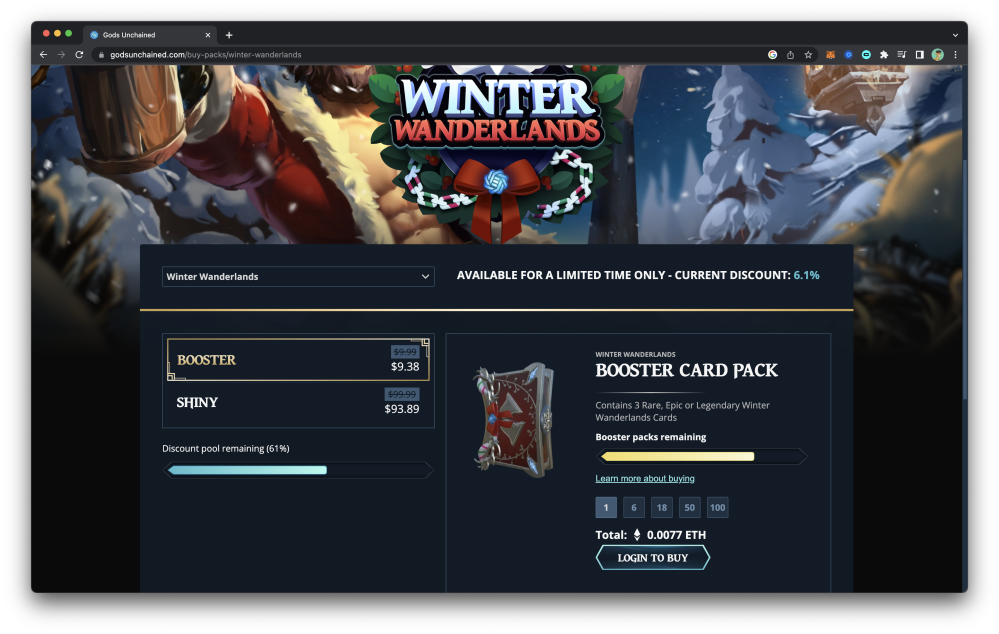

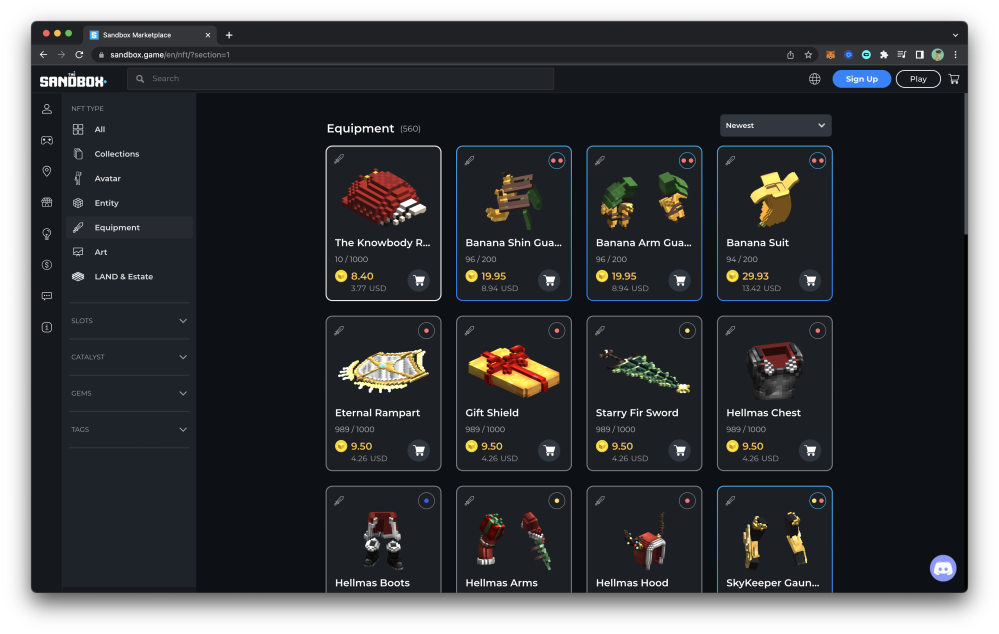

- In-game items: Some video game developers are using NFTs to represent in-game items, such as weapons, armor, or other virtual goods. These NFTs can be bought, sold, and traded within the game or on external marketplaces.

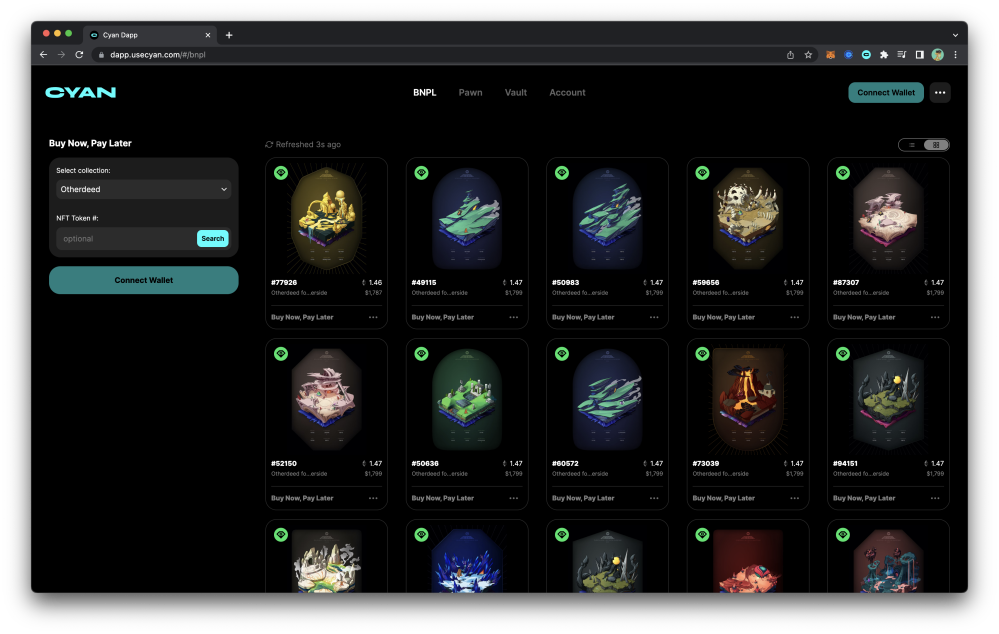

- Virtual real estate: NFTs can also be used to represent ownership of digital real estate, such as plots of land in metaverses, virtual worlds, or virtual property in online games.

- Other digital assets: NFTs can represent a wide range of other digital assets, such as music, videos, domain names, and documents.

There are several strategies that you can use to find NFTs that align with your interests and values:

- Search for NFTs on marketplaces that specialize in your area of interest. For example, if you’re interested in art, look for NFT marketplaces that focus on digital art. SuperRare and ArtBlocks are great places to start for artwork.

- Follow creators and artists whose work aligns with your interests and values. Many artists and creators have social media profiles where they share their work and information about upcoming NFT releases.

- Attend online events and conferences related to NFTs and your area of interest. These events can be a great way to learn more about the NFT market and discover new creators and projects. One of the best ways is through Twitter Spaces, or for those who can’t catch the live broadcasts, podcasts done by Rug Radio or Bankless are where folks usually start.

- Consider joining online communities or forums dedicated to NFTs and your area of interest. These communities can be a great source of information and a way to connect with other like-minded individuals. Discord is a great place to start. Twitter is also the usual hangout for NFT nerds, though it tends to be littered with noise.

By taking the time to identify your interests and values and actively seeking out NFTs that align with them, you can increase the chances of finding NFTs that are meaningful and fulfilling to you!

Storage and security for NFTs

It’s important to securely store NFTs to protect them from theft, loss, and other risks. The best way to achieve this is by using a Ledger Hardware Wallet and tying it to a MetaMask wallet. However, given the peer-to-peer nature of NFTs, your NFTs are usually stored directly in your wallet, such as MetaMask, so they are technically more secure vs. handling a token. NFTs by nature are self-custodied most of the time, so for security, the best measure is to prevent being phished or scammed. Below are some of the best methods to prevent falling for them:

- Never click on links: always start with “never trust, verify first” when receiving links from any source. If you must check, open the link in a fresh incognito browser so your wallet and private information are not affected. And always only trust links directly from the NFT seller, either through their Twitter, Discord, or Websites.

- Avoid trading directly with another buyer: the quickest way to lose your NFT is to sell it to an anonymous stranger on the internet. Usually, scammers will persuade you into a trade, send you to a scam site to deposit your NFTs, and completely ghost you. Just avoid direct trades and you’ll eliminate most of your headaches.

Using basic internet hygiene when dealing with NFTs will go a long way. Otherwise, NFTs are a relatively safe asset to hold, so long as your wallet is safely secured. Don’t ever share your wallet keys with anyone, and never connect your wallet to unknown sites. Stick to what you know, like OpenSea, LooksRare, and Cyan!

Future Potential

The NFT industry is moving rapidly. There are a few potential future developments and trends that could shape the NFT market further into 2023 and beyond:

- Increased adoption and use cases: As NFTs gain more mainstream recognition and adoption, we will likely see a wider range of use cases for NFTs. This could include everything from digital art and collectibles to virtual real estate, gaming items, and even traditional assets like real estate, fine art, and luxury goods.

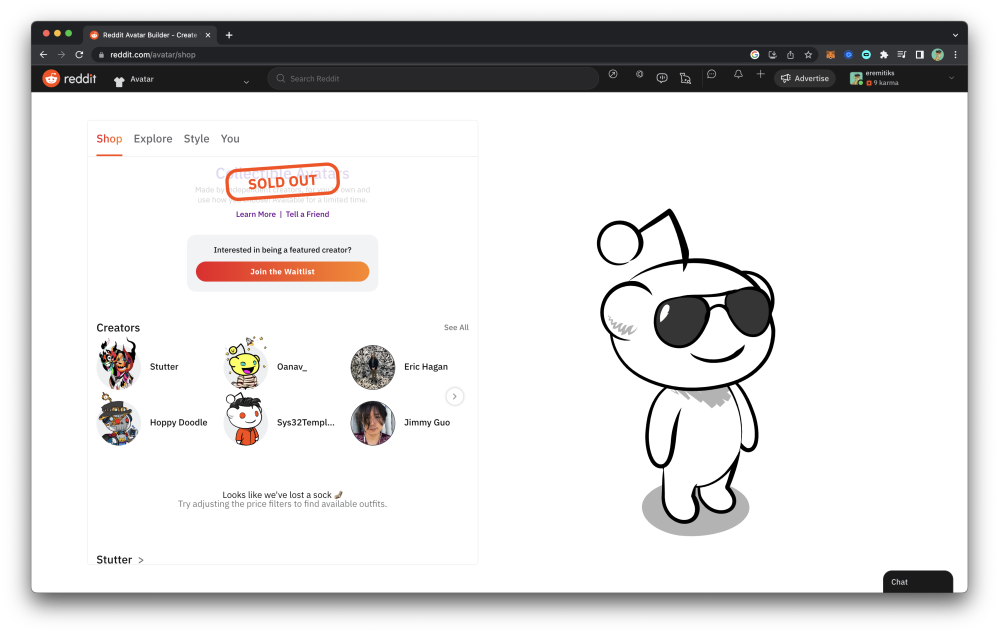

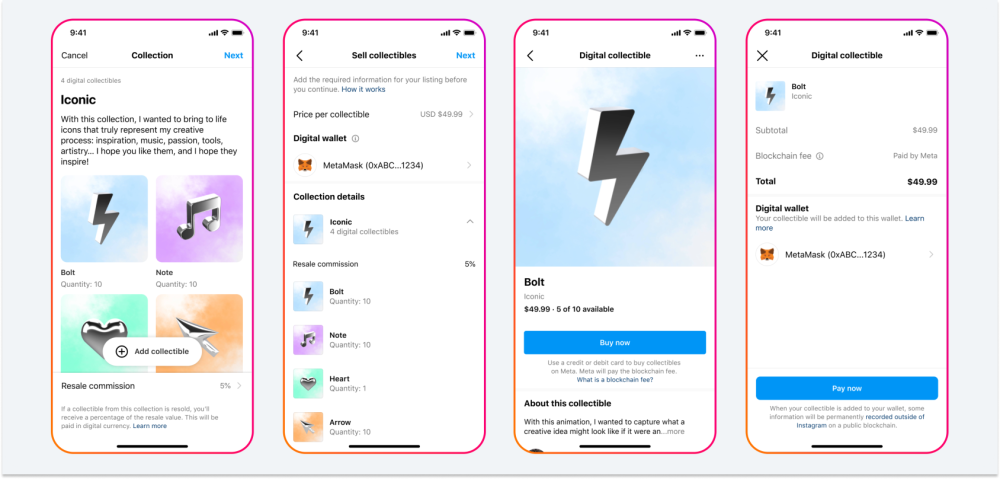

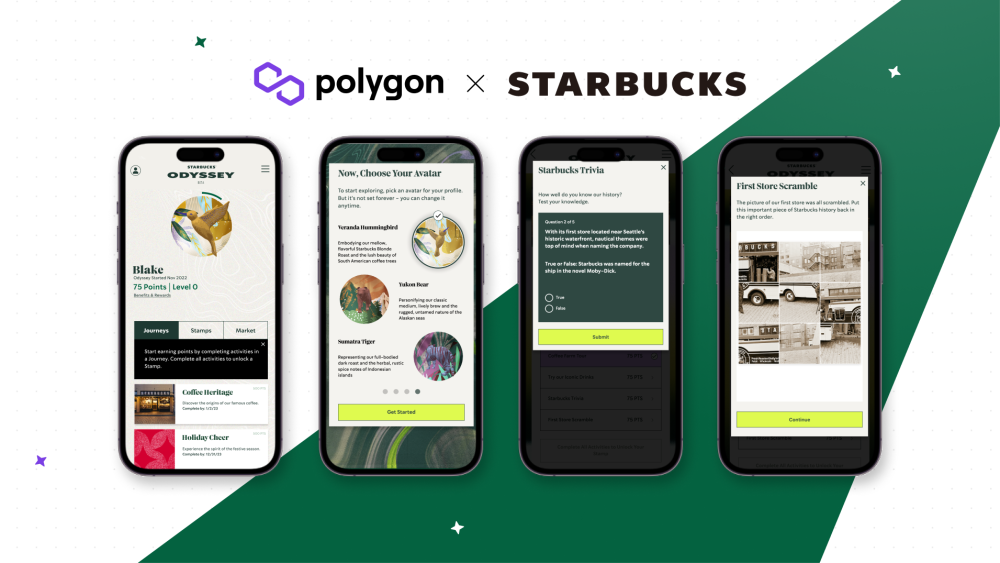

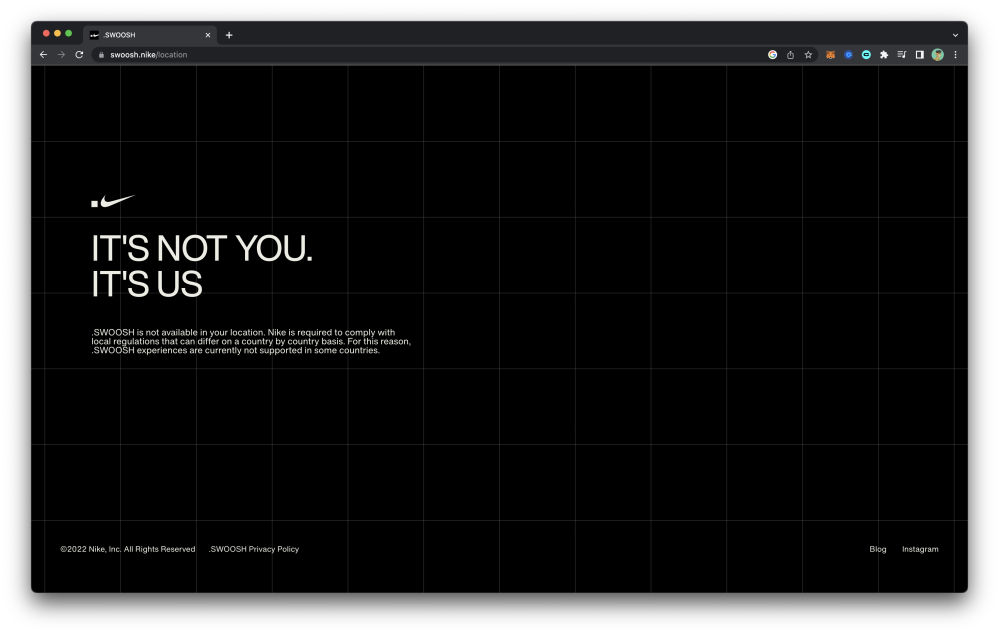

- Integration with existing systems and platforms: NFTs have the potential to be integrated with a variety of existing systems and platforms, such as social media, e-commerce, and gaming. This could make it easier for people to buy, sell, and trade NFTs and could lead to more widespread adoption of the technology. Many traditional companies like Nike, Instagram, and Starbucks are making a shift toward NFTs.

- Development of new NFT platforms and marketplaces: As the NFT market grows, it is likely we will see the development of new platforms and marketplaces specifically designed for buying, selling, and trading NFTs. These could include both centralized and decentralized platforms.

- Increased regulation: As the NFT market grows and becomes more mainstream, it is possible that we will see increased regulation of the market. This could include measures to protect consumers and ensure the authenticity and integrity of NFTs. The crackdown on influencers in the industry will be beneficial in the long run.

Coffeezilla, an investigative YouTuber, has recently covered the CryptoZoo scandal – a project headed up by influencer Logan Paul

Here are a few recommendations for NFT buyers looking to make long-term investments:

- Invest in NFTs that have strong underlying value: Look for NFTs that are backed by strong brands, organizations, or artists with a proven track record. These NFTs are likely to have more staying power and could be more likely to appreciate in value over time.

- Diversify your portfolio: Don’t put all of your eggs in one basket. Consider investing in a variety of NFTs across different categories, such as digital art, collectibles, virtual real estate, gaming items, and traditional assets. This can help to spread risk and potentially increase your chances of long-term success.

- Stay up-to-date on market trends and news: Keep an eye on the NFT market and pay attention to trends and news that could impact the value of your investments. This can help you make informed decisions about when to buy or sell NFTs. A good site for NFT news is nftnow.

- Be patient: The NFT market is still relatively new and is likely to be volatile in the short term. Don’t expect to see immediate returns on your investment. Instead, be patient and focus on building a diversified portfolio for the long term.

Finally, only invest what you can afford to lose! As with any investment, there is always the risk of loss. Make sure to only invest money that you can afford to lose and be prepared for the possibility that the value of your investments may fluctuate over time.

In conclusion

NFTs offer a unique and potentially lucrative opportunity for buyers and investors. By buying NFTs, individuals can own and control digital assets in a way that was previously not possible. However, as with any investment, it is important to do careful research, diversify your portfolio, and be aware of the risks and challenges involved. As the NFT market continues to grow and evolve, it will be important for buyers to stay up-to-date on market trends and developments and to be mindful of ethical and legal considerations. With careful planning and consideration, NFTs can be a valuable addition to any investment portfolio!

References

Rarity Sniper: https://raritysniper.com/

Etherscan: https://etherscan.io/

OpenSea: https://opensea.io/

Otherside: https://otherside.xyz/litepaper

CryptoSlam: https://www.cryptoslam.io/

Icy Tools: https://icy.tools/

ArtBlocks: https://www.artblocks.io/

Gods Unchained Cards: https://godsunchained.com/

Sandbox Shop: https://www.sandbox.game/en/shop/

SuperRare: https://superrare.com/

Rug Radio: https://www.rug.fm/

Bankless Podcast: http://podcast.banklesshq.com/

Ledger Wallet: https://shop.ledger.com/pages/ledger-nano-x

MetaMask Wallet: https://metamask.io/

LooksRare: https://looksrare.org/

Reddit Avatars shop: https://www.reddit.com/avatar/shop

Instagram NFT marketplace: https://about.fb.com/news/2022/05/introducing-digital-collectibles-to-showcase-nfts-instagram/

Starbucks Reward Program: https://polygon.technology/blog/starbucks-odyssey-beta-is-now-live-on-polygon

Swoosh.nike: https://www.swoosh.nike/location

Coffeezilla channel: https://www.youtube.com/@Coffeezilla

nftnow: https://nftnow.com/