In the ever-evolving world of digital assets, Non-Fungible Tokens (NFTs) have established themselves as a significant component of the market, offering creators and collectors unique opportunities for investment, collection, and now, monetization without the need to part with their valuable assets. One innovative strategy that has gained considerable traction is the use of NFT loans. This method allows NFT owners to unlock the financial value of their digital assets while retaining ownership.

This article delves into the concept of NFT loans, explains how they work, and provides practical steps to effectively leverage them.

Table of Contents

Understanding NFT Loans

NFT loans are a form of secured lending where the borrower uses their NFT as collateral to obtain a loan, either in fiat currency or cryptocurrency. This financial model is particularly appealing in the NFT space as it provides liquidity to asset holders without requiring them to sell their assets. NFT loans mirror traditional asset-backed lending but are specifically tailored to the unique characteristics of NFTs.

How NFT Loans Work

The process of obtaining NFT loans is straightforward yet secure, involving several key steps:

- Collateralization: The borrower deposits their NFT into a smart contract as collateral. This smart contract acts as an escrow, securely holding the NFT until the loan terms are fulfilled.

- Loan Agreement: The terms of the loan, including the loan amount, interest rate, and repayment period, are agreed upon by the borrower and lender. These terms are usually facilitated through platforms that specialize in NFT loans.

- Funding: Once the loan terms are established and the NFT is deposited, the lender provides the loan amount to the borrower, either in cryptocurrency or fiat currency.

- Repayment: The borrower must repay the loan along with any agreed-upon interest by the end of the loan term. If the borrower successfully repays the loan, the NFT is returned to them. However, if they default, the lender claims ownership of the NFT.

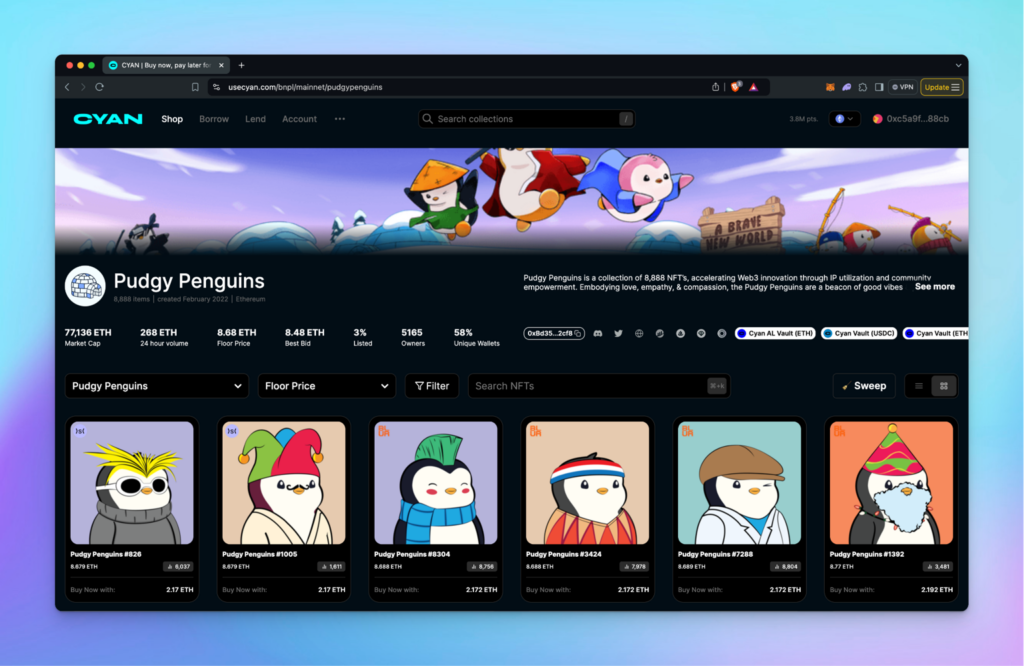

Special NFT marketplaces like Cyan also offer the option to sell your NFT to pay off the loan, providing an alternative repayment method.

Steps to Monetize NFTs Through NFT Loans

To effectively monetize your digital assets through NFT loans, follow these steps:

1. Evaluate Your NFT’s Value

Before seeking NFT loans, assess the market value of your NFT. This can be done by evaluating recent sales of similar NFTs, the rarity of your NFT, its historical significance, and its demand within the community. Understanding your NFT’s value will help you negotiate better loan terms.

2. Choose a Reliable Platform

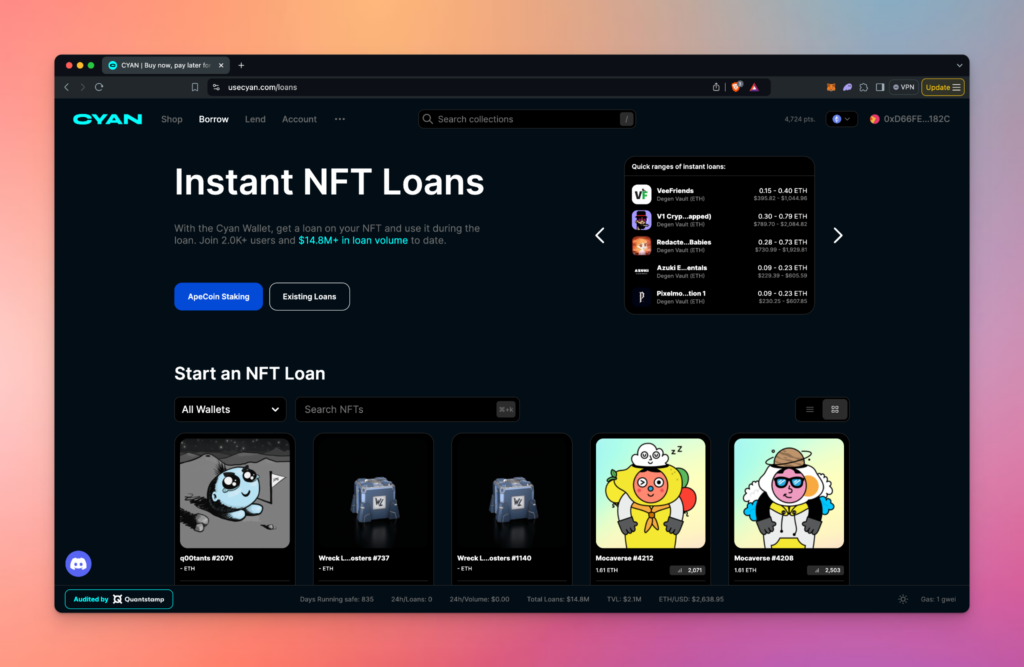

Select a platform such as Cyan’s NFT marketplace that facilitates NFT loans. Look for platforms with robust security measures, transparent terms of service, and positive community feedback. At Cyan, we pride ourselves on being one of the best NFT loan platforms, offering features like easy loan access, flexible repayment options, and a seamless buying experience without the need for registration.

3. Understand the Terms

Carefully review the loan terms offered by potential lenders. Pay close attention to the loan-to-value (LTV) ratio, interest rates, repayment period, and any additional fees. The LTV ratio is particularly important as it determines how much you can borrow against the value of your NFT. An informed understanding of these terms is crucial for making the most of NFT loans.

4. Prepare for Collateralization

Ensure your NFT is ready to be transferred to a smart contract. This might involve moving it to a compatible wallet or platform. Familiarize yourself with the process and any potential risks associated with smart contract interactions. On Cyan, you can simply connect your wallet and get started—no registration is required.

5. Repay the Loan Responsibly

Plan your repayment strategy to avoid defaulting on the loan. Consider how the loan impacts your overall financial situation and ensure you have a reliable source of income to meet your repayment obligations. If you face a shortage of funds, Cyan allows you to sell your NFTs to repay loans, potentially even earning extra if your dues are lower than the NFT’s selling price. Here are some benefits and risks:

Benefits:

- Liquidity: NFT loans provide immediate liquidity, allowing you to leverage the value of your NFTs without selling them.

- Ownership Retention: You maintain ownership of your NFT and can benefit from any appreciation in its value over the loan term.

Risks:

- Default Risk: Failure to repay the loan could result in the loss of your NFT to the lender.

- Market Volatility: The value of NFTs can be highly volatile, and a significant drop in market value could affect the loan terms or your ability to repay.

Conclusion

NFT loans offer a compelling method for NFT owners to monetize their digital assets while retaining ownership. By understanding the mechanics of NFT loans and carefully navigating the terms and platforms available, NFT holders can unlock the financial potential of their collections. However, as with any financial endeavor, it’s crucial to weigh the benefits against the risks and proceed with informed caution.

With the right approach, NFT loans can be a valuable tool in your financial strategy, providing liquidity and investment opportunities in the ever-expanding digital asset market. At Cyan, we strive to make your NFT buying, selling, and loan experience as seamless and beneficial as possible.