Yes, you can. Even though digital asset-backed loans have been available for some time, high-quality loan providers were scarce until recently. With the introduction of Cyan, obtaining NFT loans has become as straightforward as swapping cryptocurrency. Cyan makes the process incredibly easy and efficient.

Cyan not only helps you secure these loans but also provides ways to repay them. Additionally, you can earn extra income from your digital assets, which can be used to cover part of the loan repayment.

Table of Contents

How do these Loans Work?

NFT loans function similarly to traditional loans, with your asset acting as collateral. If you fail to repay the loan, the lender is entitled to sell your NFT to recover the outstanding amount. On Cyan, NFT loans are typically issued at up to 75% of the asset’s appraised value. This conservative loan-to-value ratio is due to the inherent volatility in the crypto markets, which can significantly impact the value of the collateral during the loan term.

If the borrower fails to repay the loan on time, Cyan reserves the right to forfeit the asset as well as any previous payments made. This ensures that the lender’s risk is minimized, and the platform remains secure and reliable for all users.

Types of NFT-backed Loans

NFT-backed loans on Cyan can be categorized into two main types: purchasing assets on deferred payments and collateralizing assets to obtain a loan. In both scenarios, the user is essentially taking out an NFT loan.

In the first case, users can stake their digital assets as collateral to earn additional rewards or to cover partial payments. This approach allows users to maximize the utility of their assets while still benefiting from the liquidity provided by the loan.

The second type involves using NFTs as collateral to secure cryptocurrency loans. By leveraging their digital assets, users can access funds without having to sell their valuable digital assets.

Why Cyan is the Best Platform for Loans

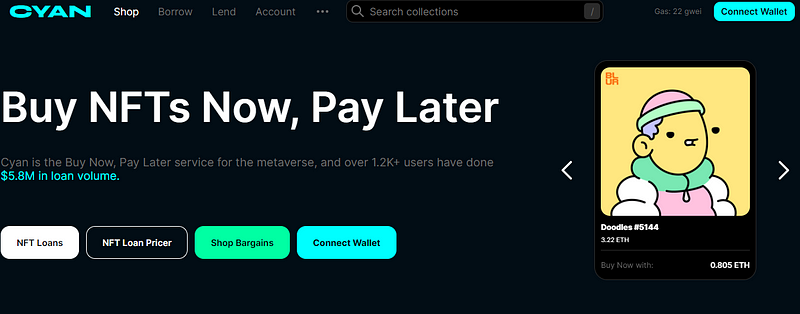

Cyan has quickly become the go-to platform for loans, thanks to our user-friendly interface, flexible repayment options, and innovative features.

1. Buying with Loans

If you’re looking for the easiest way to purchase an NFT on loan, Cyan is the platform for you. The process of buying an asset on loan through Cyan is not only straightforward but also secure. Additionally, if you’re unable to repay the loan, Cyan offers the option to sell the assets and use the proceeds to pay off the debt. This flexibility makes Cyan an ideal platform for users who want to manage their assets without the risk of losing them.

Benefits of Buying on Loan from Cyan

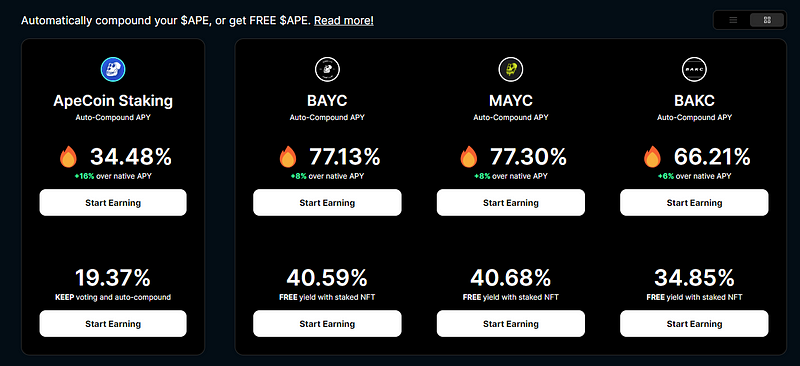

One of the unique benefits of buying assets on loan from Cyan is the ability to earn additional income from the same asset. By staking your NFT on Cyan, you can generate rewards that help offset the cost of the loan. This dual benefit—accessing liquidity while earning returns—makes Cyan an attractive option for enthusiasts.

For example, certain collections, like the Bored Ape Yacht Club (BAYC), allow users to stake their assets to earn rewards in the form of ApeCoins. These rewards can be used to cover loan payments, effectively reducing the overall cost of acquiring the asset.

How to Get These Dual Benefits

When you obtain a loan from Cyan’s marketplace, you have the option to stake the collateralized asset as well. This allows you to earn staking rewards, which can be applied toward repaying the loan. Additionally, you can purchase the NFT directly from the Cyan marketplace, streamlining the entire process.

Understand with an Example

Suppose you purchase a Bored Ape Yacht Club from Cyan’s marketplace. You choose to buy it using a deferred payment plan spread over three months. During this period, you can stake the BAYC to earn additional income, which can be applied to the loan payments. By doing this, you effectively reduce the overall cost of the purchase, making it more affordable.

How to buy on Loan in Cyan?

Cyan’s Buy Now Pay Later (BNPL) service allows users to purchase NFTs over three months. After making a down payment, users make payments every 31 days until the final payment is completed. There’s no need to worry about margin calls or other complications.

To get started:

- Go to the Account Page on Cyan.

- Connect your wallet.

- Click on the “Borrow ETH” button near the desired asset in your wallet.

- Turn on auto-repayments if you prefer. You’ll receive alerts if your funds are low before a scheduled payment.

- Submit the transaction. You’ll need to move the digital asset from your wallet (MetaMask or other) to your Cyan wallet.

Note: By starting a loan, the user agrees that any missed payments will result in the forfeiture of the NFT and all payments made to date.

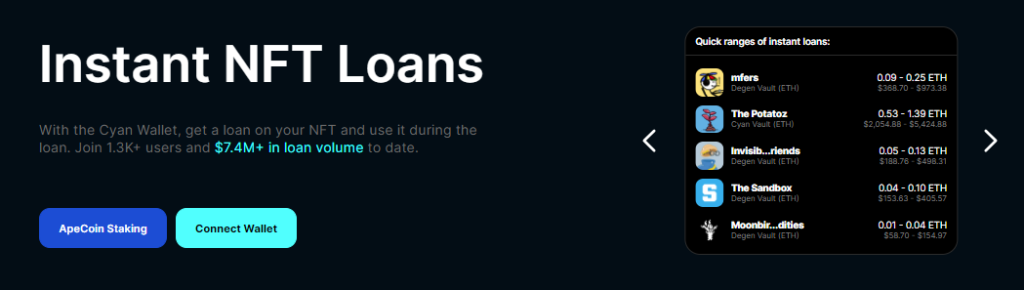

2. Asset-Backed Loans on Cyan

Cyan offers flexible asset-backed loan options, allowing users to borrow ETH based on the appraised value of their NFTs. You can borrow ETH for up to 75% of the asset’s appraisal for up to three months.

If you have idle NFTs and need to generate cash quickly, you can collateralize them and get an NFT-backed loan in just a few seconds on Cyan. The process is straightforward:

- Connect your wallet.

- Go to the Loans page.

- Select the NFT you want to collateralize.

- Submit the transaction.

If you decide to sell the NFTs to cover the loan payment, Cyan allows you to do so with a single click, making the entire process seamless and efficient.

In conclusion, NFT loans are becoming increasingly popular as more people seek liquidity options for their digital assets. Cyan stands out as a top platform for obtaining NFT loans and NFT-backed loans, thanks to its innovative features, flexible options, and user-friendly interface. Whether you’re buying NFTs on loan or using them as collateral, Cyan offers a comprehensive solution that meets the needs of today’s NFT enthusiasts.