With NFTs and blockchain technology, our lives would be much easier. Easy transactions, instant authentication, less regulatory interference and a lot of other benefits.

Some of these technologies have already stepped in while others are just getting ready.

This article explores some ways where NFT Finance could help us in streamlining our daily lives and increase the efficiency of daily use financial systems.

Table of Contents

1. NFTs as Financial Assets

NFTs are unique digital assets verified using blockchain technology, which makes them indivisible and unreplicable. Unlike cryptocurrencies like Bitcoin or Ethereum, which are fungible, each NFT has a distinct value based on its attributes.

A concept has emerged lately called Real World Tokenized Assets which helps in tokenization (into crypto) of real world assets such as stocks, bonds, etc.

Tether CEO Paolo Ardoino announced on 18th of April 2024 at Token 2049 Dubai that they would soon bring a platform for these assets.

Once successful, soon they might also be collateralized for loans. This would be very similar to granting NFT loans.

A few key applications include:

- Art and Collectibles: High-profile sales, such as Beeple’s artwork fetching over $69 million, have spotlighted NFTs as lucrative investment assets.

- Real Estate and Intellectual Property: Tokenizing physical assets and intellectual property into NFTs allows for fractional ownership and easier transferability, broadening the investor base and liquidity.

- Real World Assets such as stocks, bonds, houses, cars, and several other items could be tokenized.

2. NFTs in Decentralized Finance (DeFi)

DeFi leverages blockchain to remove intermediaries in financial transactions. NFTs contribute to this by facilitating novel forms of asset management and investment.

- Collateralization: NFTs are being used as collateral in lending platforms, where borrowers can secure loans against their NFT holdings.

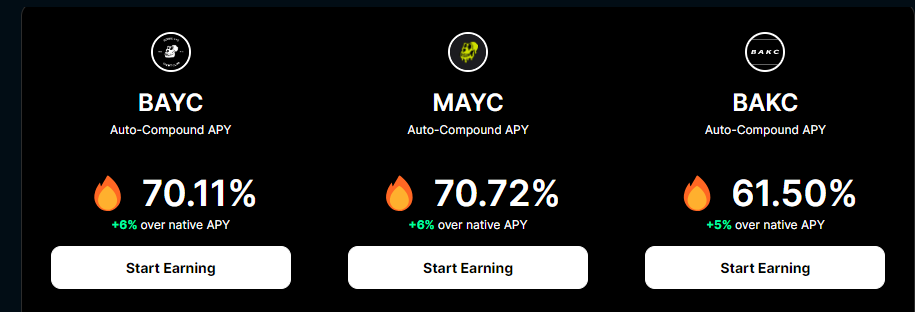

- Yield Farming and Staking: Some platforms allow NFT holders to stake their assets to earn a yield, similar to interest in traditional banking. Cyan is one such platform where you could stake your Ape NFTs to get as high as 70% APY.

3. Fractional Ownership of Assets with NFT Finance

One significant advancement NFT Finance introduces is fractional ownership of high-value assets, enhancing liquidity in traditionally illiquid markets such as art.

Applications

- Fractional NFT Platforms: These platforms divide an NFT into several parts, each part representing a share in the ownership of the asset. This division makes high-value NFTs accessible to smaller investors.

- Liquidity Pools: NFT owners can pool their assets to create a liquid market where shares of NFTs are bought and sold, thus providing exit options for investors.

- Stocks could be sold as fractionalized NFTs in the future because a trend of Real World Tokenized Assets have already picked up pace.

4. Financial Services

The evolution of NFT marketplaces has been instrumental in supporting the financialization of NFTs. These platforms now offer more than just buy-and-sell transactions.

Some possible innovations:

- Escrow and Auction Services: Advanced trading mechanisms are being implemented to ensure secure and fair trading.

- Financial Instruments: Some marketplaces are exploring NFT-backed derivatives, bonds, and more, expanding the utility of NFTs in finance.

Challenges

While NFT Finance is burgeoning, several hurdles need addressing to ensure its sustainable integration into the broader financial landscape.

- Scalability: High transaction fees and slow network speeds on platforms like Ethereum can hinder the scalability of NFT transactions.

- Market Volatility: The NFT market is highly speculative and can be prone to significant price fluctuations, which pose risks to investors.

- Market Status: NFT markets are going though a rough patch these days

Conclusion

NFT Finance is at a nascent stage, yet it holds immense potential to redefine asset management and investment paradigms.

As technology evolves and regulatory frameworks become clearer, NFTs may become integral to the financial systems of the future. The example of Tether’s RWT platform is one such step.

Once implemented, it would create a much secure way of doing business where buying and selling things would be much easy, regulatory concerns would be far less and there would be an efficiency in the overall markets.