We have taken out the most comprehensive report on why NFT markets are witnessing a downturn and what is needed to revive them. The report includes data, overview on laws, status of markets and some very critical suggestions that can jumpstart the NFT markets worldwide.

Table of Contents

Will NFT Markets See a Revival in 2024? An In-depth Analysis

The NFT markets have seen a whirlwind of activity since its inception, capturing the imagination of artists, collectors, and investors alike.

In 2021, the market saw unprecedented growth, with high-profile sales and mainstream media attention highlighting the potential of NFTs to revolutionize digital ownership and creativity. However, the euphoria was short-lived.

By 2022 and into 2023, the market faced a significant downturn, with declining sales volumes, falling prices of major NFT collections, and growing skepticism about the sector’s sustainability.

As we step into 2024, the critical question emerges: Can the NFT market experience a revival? This article delves into the current state of the NFT market, exploring the factors that led to its decline and evaluating the potential catalysts for its resurgence.

We have also shown some unique facts on why you should buy NFTs now.

The Decline of NFT Markets

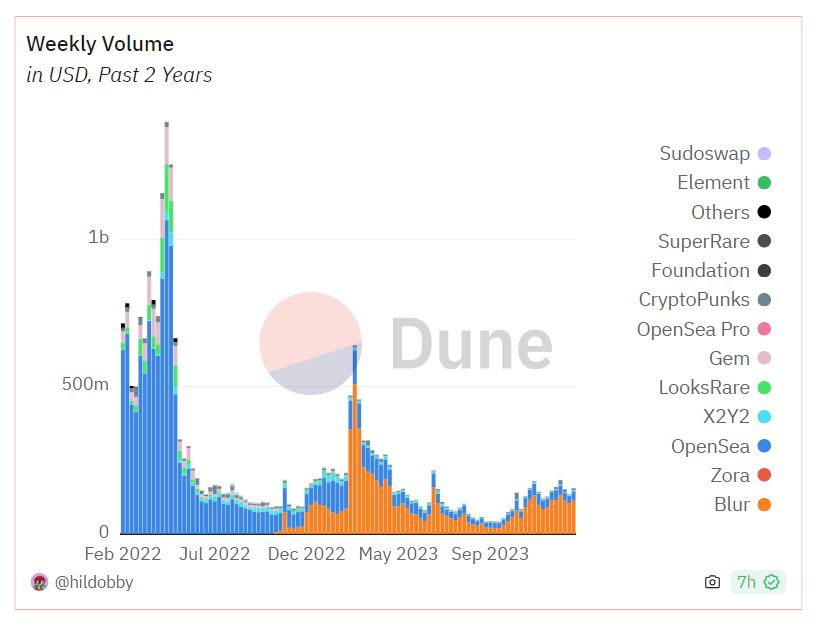

Since their last decline during the crypto winter, NFT markets have rarely recovered in the future, Even when crypto markets are about to reach a $2 trillion market cap, NFTs are still at a fraction of their 2021 volumes.

NFT Volumes Not Fully Recovered

The NFT market’s contraction is evident in the dramatic decrease in sales volume. After reaching a peak in 2021 with sales nearing $881 million in a single month, the market has not managed to sustain such figures.

By January 2024, the total sales value over 30 days plummeted to $11.8 million, signaling a stark reduction in market activity. This decline reflects a broader loss of confidence among investors and collectors, who have become wary of the speculative nature of many NFT projects.

Fall in Prices

The devaluation of major NFT collections has been a significant blow to the market’s credibility. Collections that once sold for millions of dollars have seen their value diminish, leaving many investors with substantial losses. This downturn has been attributed to a combination of factors, including market saturation, a lack of sustainable demand, and the speculative bubble bursting.

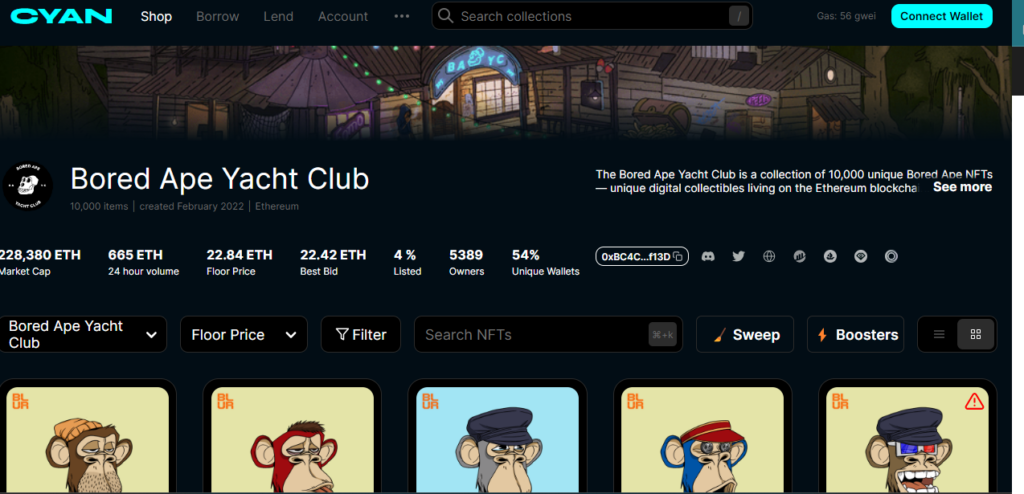

For example, a BAYC NFT which is listed in our store. For the collection, in April 2022, the floor price was 153 ETH. This reduced to 28.5 ETH as of July 2023. Now, in Feb 2024, the floor price again sunk to a new low of 22.84 ETH.

However, for such highly sought after NFTs, you could purchase them and add them to your collections. When markets recover, which everyone is sure about, then these NFTs can be sold at several times of their price.

You can also explore other collections on CYAN.

Causes of the Decline in the NFT Market Sales

Though there are several reasons, yet most of them do not have much impact. We have selected a few reasons which had the highest impact on the sales. These are the high fees on Ethereum and the lack of utility of NFTs.

We will also show you how you can monetize your NFTs without selling them.

High Gas Fees

One of the primary deterrents for participants in the NFT space has been the high transaction (or “gas”) fees on the Ethereum network, where a significant portion of NFT trading takes place. These fees can vary widely, spiking during periods of high demand, which has made trading cost-prohibitive for many users.

Lack of Utility Beyond Digital Art

While NFTs initially captured public imagination through digital art and collectibles, the novelty has worn off for many as the market became saturated with similar offerings.

The lack of broader utility in many NFT projects has left investors questioning the long-term value of their assets.

Projects that offered little more than digital bragging rights have seen a particularly steep decline in interest and value.

Cooling Interest in Metaverse Projects

The metaverse concept, a collective virtual shared space created by the convergence of virtually enhanced physical and digital reality, was another driver of NFT growth. However, as the broader tech sector faced challenges, funding and interest in metaverse projects cooled.

NFTs markets used to depend a lot on metaverses for NFT sales.

The decline in metaverse enthusiasm has directly impacted NFTs associated with virtual real estate and other metaverse-related assets, contributing to the market’s overall downturn.

What is Needed for a Revival?

NFT markets are surely heading for a revival with several NFT-based businesses introducing new ways of using NFTs. For example, we at CYAN, have shown the use case of NFT-loans and we are proud to be the best NFT loan provider in the entire market.

Introduction of New Use Cases

For the NFT market to experience a revival, it will require the introduction of new use cases that extend beyond the realm of digital art and collectibles. NFTs have the potential to revolutionize various sectors by providing a means to securely and transparently verify ownership and provenance of a wide range of assets, from real estate to intellectual property.

Some of the new use cases of NFTs without much changes can be:

- Soulbound Tokens

- Asset Tokenization

Shift Towards Utility-Oriented NFTs

A shift towards utility-oriented NFTs could significantly enhance the market’s appeal. For instance, NFTs could represent ownership in physical assets, access to services, or participation in decision-making processes within decentralized autonomous organizations (DAOs). Projects that focus on creating tangible value for NFT holders are more likely to sustain interest and investment in the long term.

The Impact of AI on NFTs

The integration of Artificial Intelligence (AI) with NFTs presents exciting opportunities for innovation. AI can be used to create unique, evolving digital artworks, to manage and curate NFT collections, or even to generate personalized NFTs based on user preferences. The convergence of AI and NFTs could open up new avenues for creativity and functionality, attracting a broader audience to the market.

Regulatory Landscape: Challenges and Opportunities

The regulatory approach to NFT markets varies significantly across the globe, reflecting the diversity of legal systems and the nascent state of this market. These regulatory stances impact everything from taxation to the recognition of digital ownership and copyright, shaping the future trajectory of the NFT markets.

India: Only Taxation is Clear on NFTs

In India, the government has taken a clear stance on the taxation of NFT transactions. Creators of NFTs, as well as those who earn profits from trading NFTs, are subject to a 30% tax.

This high tax rate underscores the need for creators and investors to carefully navigate the financial implications of their activities in the NFT markets.

Europe: MICA and NFT Regulation

The European Union’s Markets in Crypto-Assets (MiCA) regulation has explicitly stated that, for the time being, NFT markets will not be regulated under its framework. This decision raises important questions about how copyright and other intellectual property (IP) laws will apply to NFTs in the absence of specific regulatory guidance.

The lack of regulation could lead to uncertainty around the enforcement of IP rights in digital assets, necessitating a closer examination of existing copyright laws to protect creators and owners.

The United States

In the United States, the Securities and Exchange Commission (SEC) views NFTs as digital assets. Given the broad mandate granted to the SEC by Congress to regulate securities, including NFTs, the legal scrutiny of NFTs focuses on the “economic reality” behind the product rather than its form.

This approach implies that certain NFTs, depending on their structure and the rights they confer, could be subject to securities regulations, affecting how they are marketed, sold, and traded.

United Arab Emirates

The UAE, particularly in jurisdictions like the Abu Dhabi Global Market (ADGM) and Dubai International Financial Centre (DIFC), has implemented regulations around crypto and virtual assets.

These regulations apply based on the actual use of such assets by way of business, providing a framework for the operation and trade of NFTs within these financial hubs.

The approach aims to foster innovation while ensuring market integrity and investor protection.

UAE is also one of the most NFT-friendly countries around the world. If you make NFTs by buying and selling them, you will be taxed 0%.

Japan

In Japan, the legal framework allows for the transfer of copyright along with the transaction of NFT art. This means that when an NFT representing a piece of art is sold, the copyright of the artwork can also be transferred to the buyer. This provision ensures that the ownership rights of digital art are clearly defined and protected, enhancing the value proposition for creators and collectors in the NFT space.

Strategic Recommendations for NFT Holders

The NFT markets are at a stage where you can earn the most profits. This is similar to the situation around Jan 2022 when Bitcoin was at $16,000. Now the same Bitcoin has increased 325% to reach $52,000.

If you have missed that train, make sure you catch the NFT one.

Diversify and Research

- Diversify Holdings: Given the volatile nature of the NFT market, diversification can mitigate risk. Consider spreading investments across various types of NFTs and sectors, including art, gaming, utilities, and real-world asset tokenization.

- Thorough Research: Before investing, conduct in-depth research on the NFT project, its utility, community support, and the team behind it. Look for projects with a clear roadmap, transparency, and evidence of long-term value.

Focus on Utility and Community

- Utility-Driven Investments: Prioritize NFTs that offer real-world utility or digital benefits beyond mere ownership. This could include access to exclusive content, participation in events, or governance in DAOs.

- Engage with Communities: Active communities often signal a healthy project. Engagement can provide insights into the project’s viability and future developments. Community strength can be a significant driver of value for NFTs.

Legal and Tax Considerations

- Understand the Regulatory Landscape: Stay informed about the regulatory environment in your jurisdiction, especially concerning taxation and copyright laws. Seek professional advice to navigate complexities and ensure compliance.

- Copyright Awareness: In regions like Japan, where copyright can transfer with the NFT, understand the legal implications of your transactions. This awareness is crucial for creators and collectors alike to protect their rights and investments.

Leverage Emerging Trends

- AI and NFT Integration: Keep an eye on projects at the intersection of AI and NFTs. These ventures could offer innovative solutions and new forms of value creation.

- Metaverse and Virtual Real Estate: Despite current skepticism, the metaverse concept holds potential. Consider long-term investments in virtual real estate or metaverse-related NFTs with a clear utility and user base.

Market Participation Strategies

- Active Trading vs. Long-term Holding: Decide on your strategy based on market research and personal financial goals. While some may prefer the quick returns of active trading, others might find value in holding NFTs with potential for long-term appreciation.

- Loss Mitigation: If holding loss-making NFTs, consider strategies for mitigation, such as leveraging tax write-offs (where applicable) or converting assets into more promising ventures.

Why Buy NFTs Now?

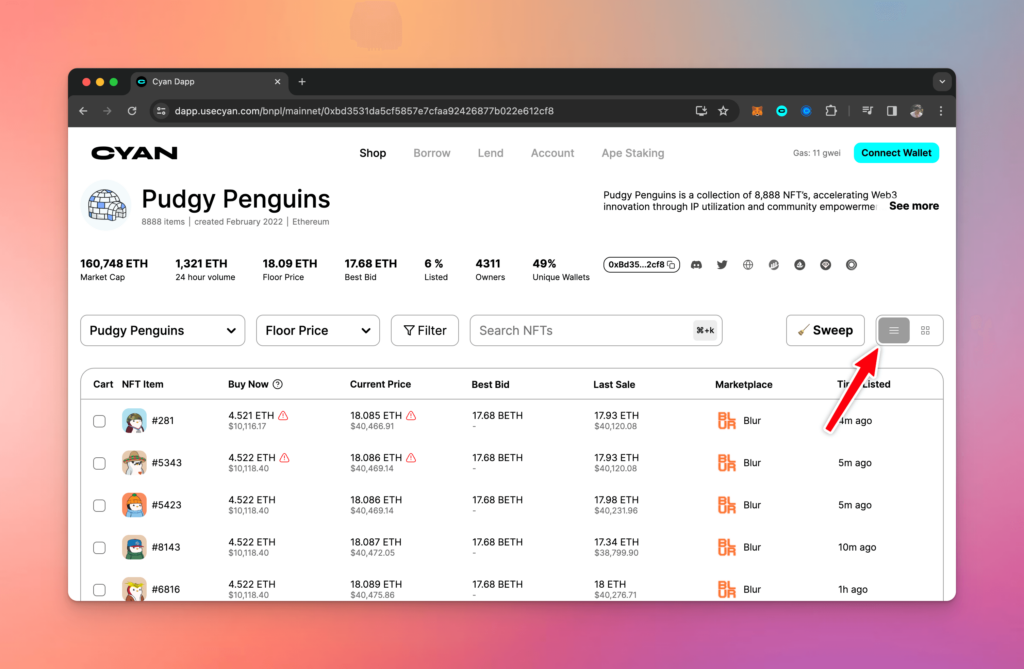

Buying NFTs on CYAN is a simple 2 step process. We have made it super simple to buy NFTs on our website. You just need to connect wallet and approve the transaction.

- Connecting Wallet: No account creation needed; users can connect their wallets directly via the “Connect Wallet” option, supporting MetaMask, Wallet Connect, Unstoppable Domains, Rainbow, and Rabbit.

- Buying Process:

- Wallet connection not required for browsing the Shop page.

- Over 107 Ethereum and 10 Polygon collections available for browsing in grid or list view.

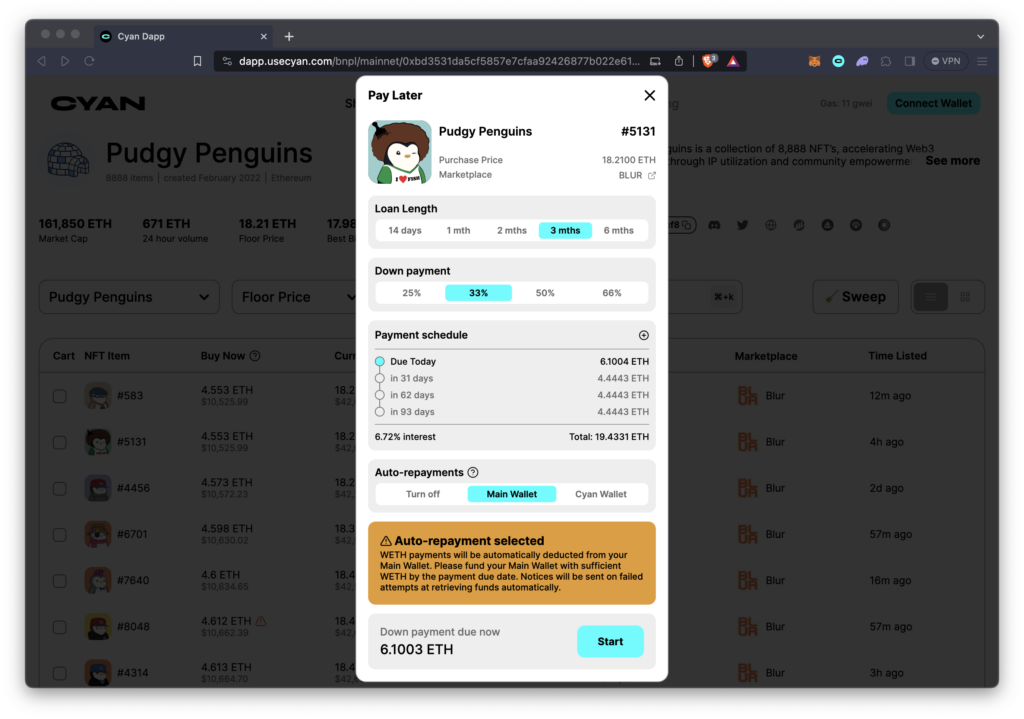

- Filters help select desired traits and pricing. Selecting an NFT opens financing terms for down payment and loan duration, with an option for automatic repayments.

- Automatic Repayments deduct funds from either the user’s wallet or a Cyan Wallet, where NFTs on loan are held.

- A Cyan Wallet is created upon the first purchase or loan, where purchased NFTs are stored until the loan is repaid.

CYAN also features easy NFT Loans (a.k.a. Buy Now, Pay Later) that help you pay for your purchases in multiple transactions and also allows users to sell the NFTs in just 1 click if they do not want the loan repayments anymore.

Conclusion

The NFT market, despite its current downturn, holds considerable potential for revival and growth. By making informed decisions, focusing on utility, engaging with vibrant communities, and staying abreast of regulatory changes, NFT holders can navigate the market more effectively. The future of NFTs may be uncertain, but with strategic planning and a focus on innovation, there are opportunities to be found. As the market evolves, flexibility and adaptability will be key to capitalizing on the emerging prospects within the NFT ecosystem.