Exploring the landscape of tokens associated with NFT loans offers valuable insights into a rapidly growing sector of the crypto economy, as highlighted here on the evolution of NFTs. As decentralized finance (DeFi) continues to expand, NFT loans have emerged as a significant innovation, allowing individuals to leverage their digital assets for liquidity. This article delves into some of the key tokens in the NFT loan ecosystem, examining their current market positions, challenges, and future potential.

Table of Contents

Top Tokens by Market Cap in the NFT Loan Space

Understanding the leading tokens by market capitalization provides insight into the most influential players within the NFT loan space. These tokens represent platforms that have successfully captured the attention of investors and users alike, often due to a combination of strong incentive structures, active communities, and practical use cases.

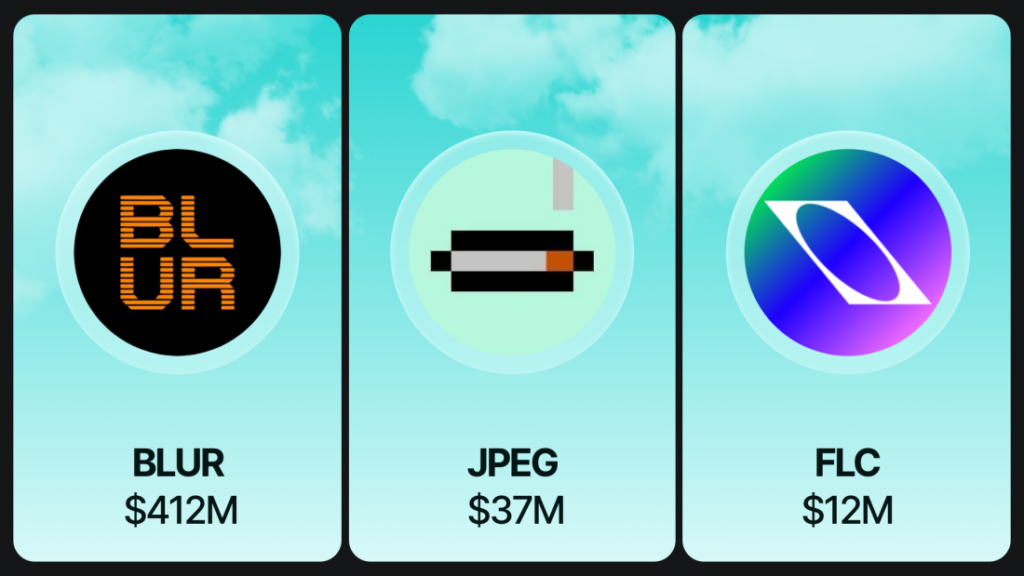

The top three tokens in this space by market cap are:

These tokens have carved out significant positions in the market. BLUR, with a market cap of $412 million, stands out as the leader. It has gained popularity due to its effective incentive structures, which have encouraged participation and growth within its ecosystem. JPEG follows with a market cap of $37 million, driven by its innovative approach to integrating NFTs with financial products. Finally, FLC rounds out the top three, although it trails behind with a market cap of $12 million, it still plays a crucial role in the NFT loan sector.

NFTFI Token Dynamics

The NFTFI token presents an interesting case within the NFT loan ecosystem. Unlike other tokens that are freely tradable, NFTFI operates under a unique structure characterized by a perpetual cycle of ‘points’ seasons. This approach affects the token’s liquidity and market dynamics, making it both a fascinating and complex asset for investors to navigate.

The cyclical nature of NFTFI tokens means that their value is not always immediately accessible or easily liquidated, creating a distinctive set of opportunities and challenges. On one hand, this structure can encourage long-term holding and engagement within the platform, potentially stabilizing the token’s value over time. On the other hand, it also limits the liquidity and flexibility that many investors seek in crypto assets, which could hinder its broader adoption.

Arcade Token Liquidity Issues

Arcade tokens, represented by the ticker $ARCD, were launched with significant fanfare a few months ago. However, despite the initial excitement, these tokens have struggled to gain the necessary liquidity to sustain a vibrant market presence. This outcome underscores the inherent volatility and risk within the NFT loan space, where even well-publicized projects can face significant hurdles.

The lack of liquidity for $ARCD highlights the importance of robust tokenomics and effective market-making strategies. Without sufficient liquidity, even the most promising tokens can fail to attract a critical mass of users and investors. This situation serves as a reminder that, while the NFT loan market is filled with potential, it also requires careful planning and execution to achieve success.

X2Y2 and BEND Protocol

X2Y2, which operates as a white label of the BEND protocol, has also faced challenges in building momentum for its token. The difficulties encountered by X2Y2 can be attributed to several factors, including the underlying tokenomics and the performance of its oracle systems. In particular, poorly performing oracles have contributed to the issuance of bad loans, which has negatively impacted stakers within the ecosystem.

The struggles of X2Y2 and BEND highlight the critical importance of infrastructure in the NFT loan space. A well-designed token is not enough; it must be supported by reliable technology and sound financial models to ensure long-term sustainability. The experience of these platforms serves as a cautionary tale for others looking to enter this competitive and fast-evolving market.

JPEGd Hype and Challenges

JPEGd is another token that initially captured significant attention, partly due to the involvement of high-profile figures like Snoop Dogg. The project successfully raised $69 million, creating considerable hype and expectations. However, despite this strong start, JPEGd has struggled to maintain its momentum, with its fully diluted valuation (FDV) dropping to $37 million.

The challenges faced by JPEGd underscore the difficulty of sustaining hype in the NFT loan space. While celebrity endorsements and large fundraising rounds can generate initial excitement, they do not guarantee long-term success. Projects must deliver on their promises and continue to innovate to maintain their market position.

FLC and NFTX Market Correction

Finally, the FLC token has experienced a market correction, bringing its valuation in line with that of NFTX, both currently valued at around $11 million. However, FLC’s fully diluted valuation remains significantly inflated at $148 million, raising questions about the sustainability of its market position.

This correction serves as a reminder of the importance of realistic valuations in the NFT loan space. While initial hype can drive up prices, long-term success depends on delivering real value to users and maintaining market confidence.

Conclusion

The NFT loan space is dynamic and still evolving, offering both exciting opportunities and significant challenges. The tokens associated with these platforms reflect broader trends within the crypto ecosystem, from the importance of liquidity and infrastructure to the challenges of sustaining market momentum.

As the NFT loan market continues to mature, staying informed and making strategic investments will be key to navigating this innovative yet volatile sector. Whether you are a seasoned investor or a newcomer, understanding the intricacies of these tokens and the ecosystems they support will be crucial for success in the rapidly evolving world of NFT loans.