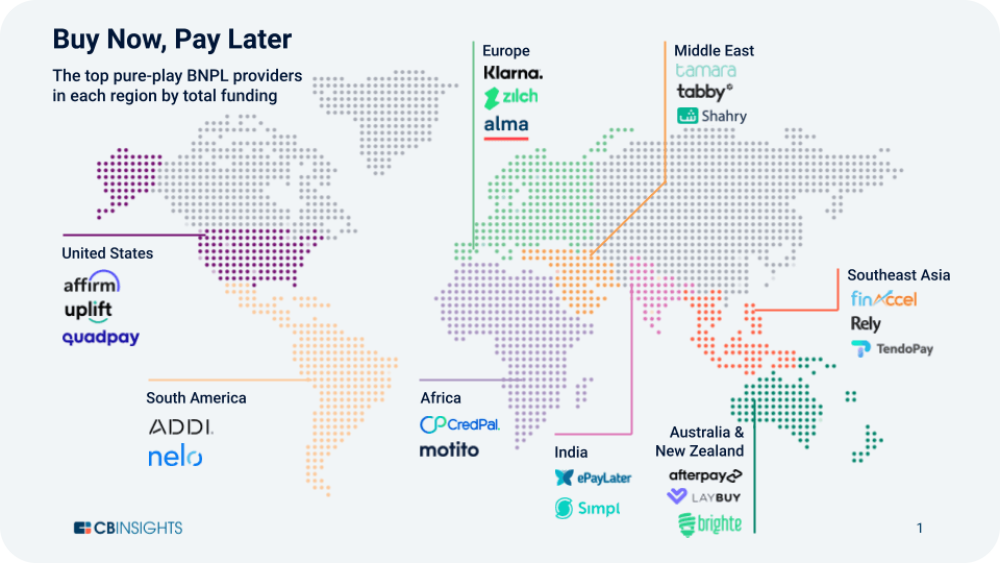

Buy Now, Pay Later, BNPL for short, is a global phenomenon allowing consumers of all income brackets to make purchases. The concept of BNPL has existed for a long time, but only in recent years has it morphed into a hip, marketing-friendly product. For many consumers, BNPL is a strong alternative to credit cards and exists as an easier way to finance purchases. In 2021 alone, BNPL accounted for roughly 2% of all global e-commerce sales! There are over 50+ companies now providing BNPL services across the globe in traditional fiat systems.

With the adoption of blockchain growing day by day, its inevitable e-commerce will migrate over as well. The added level of transparency and ease of moving funds can be a powerful ally to online stores. Given Cyan is a BNPL company residing on the blockchain, it’s in our interest to showcase the benefits. However, in this article, we’ll deep dive into both the benefits and drawbacks of having BNPL graduate to the blockchain. Let’s take an objective look at how BNPL can grow outside of traditional pipelines.

Let’s talk about Buy Now, Pay Later

The history of BNPL can be traced back to traditional brick-and-mortar retail, where stores offered credit to customers through in-house financing or credit card companies. This allowed customers to purchase items that they may not have been able to afford upfront, and pay for them over time. In-store financing was often offered through store credit cards, which often had high-interest rates and fees.

One such specific scheme is called layaway, a system where the merchant would accept a deposit and hold the item on behalf of the customer for a full purchase later in the future. The layaway model is a way to secure a good price on an item a customer may not be able to pay for today but is not allowed to take the item with them until it is fully purchased.

As e-commerce grew in popularity, BNPL evolved to include online platforms that offer deferred payment options to consumers. These platforms often offer consumers the ability to pay for items in installments, either through a BNPL platform or through a credit card with a deferred payment option.

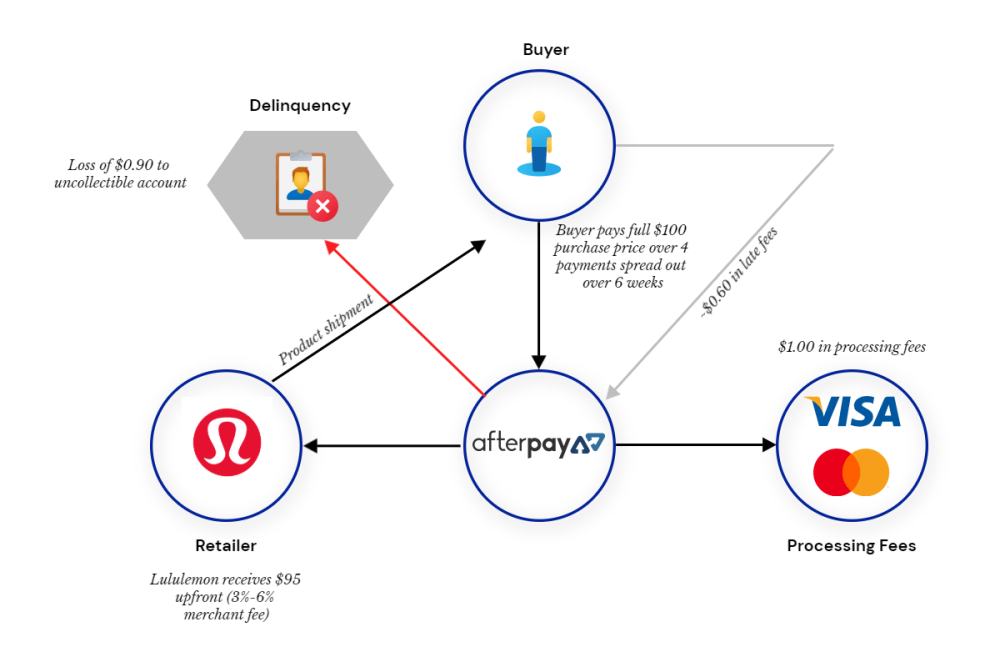

BNPL’s simplicity is what makes the payment method extremely popular. No credit or background check is necessary to get started, although it may affect your interest rates. Most services offer a financing option of 4 payments every two weeks, interest-free. A downpayment is made, and then three more payments across six weeks will complete the plan. If there are any delinquencies in payments, penalties, and interest will start to accrue. If the payment is not made, then the plan goes into default and the user will be penalized on any further purchases if any are allowed at all.

In recent years, BNPL has become even more popular with the rise of mobile payments and online shopping. Many BNPL platforms now offer consumers the ability to make purchases through their mobile phones, either through a BNPL app or through a mobile payment platform like Apple Pay or Google Pay. BNPL has also gained popularity among small businesses, which may not have the resources to offer in-store financing or accept credit card payments. BNPL platforms for small businesses often offer deferred payment options to consumers, allowing them to make purchases now and pay for them later.

The most popular BNPL companies today are Klarna, Afterpay, and Affirm. These three companies make up about 87% of the global market share of BNPL services offered. There are an estimated 20 million monthly active users globally, with roughly 9 million coming from the US alone. These companies enjoyed a huge surge of usage during the Corona shutdowns in 2020 and continued to attract users all throughout 2021-2022.

Criticisms of BNPL

Any powerful tool will have its downsides. BNPL in particular is heavily criticized for extending credit to consumers at higher rates than traditional means of credit. In the US, consumers who can’t access credit cards rely on BNPL to finance daily purchases. While these consumers can benefit from financing, the higher interest rates compared to credit cards are troublesome. However, this is also a criticism of the current credit landscape and the immense amount of gatekeeping towards lower-income households or individuals who haven’t built up enough credit early in their lives. A non-transparent system designed around measuring an individual’s creditworthiness is a dangerous practice, but thanks to BNPL, everyone has access to credit.

BNPL is also criticized by the mass media and YouTubers for its nature to attract vulnerable consumers. This is in part due to the points made above, but also due to the nature of the products some consumers are using BNPL for. Recently, many have been using BNPL for cab rides, groceries, amazon purchases, and other daily items. Using BNPL on a perishable item could seem predatory as the consumer is left paying off a balance on something that no longer exists. However, this can apply to credit cards as well, so this falls into an argument of consumer behavior.

When the criticism for targeting vulnerable consumers is made for the high interest rates offered, this is primarily driven by the fact many of these plans are defaulted on. Meaning, the consumer will take the item or perishable, and fail to repay the balance post-facto. This is an issue for both the BNPL company and consumers, as plans will have higher interest rates to compensate for the poor performance. This is no different from how insurance companies measure annual costs or how banks assess creditworthiness for a mortgage.

One demerit of using BNPL, however, is the lack of building a credit history. BNPL companies do not report payment history to credit bureaus, meaning the consumer cannot build up credit in traditional means similar to a credit card or car loan. Making payments will help the individual’s credit within the BNPL company risk profile, but will not carry over to their credit score. We’ll talk about this later in the article, but not having payments on the blockchain for transparency is a huge downside for traditional BNPL services.

Lastly, many pundits will say that BNPL encourages impulsive spending. This is in part true, as previously mentioned above, BNPL is now increasingly becoming available for perishable goods and services. Providing an easier way to finance everyday purchases may cause further impulsive buying, but again, this heavily falls on consumer behavior. For example, if providing BNPL for McDonald’s causes more purchases, and thus the potential for more defaults due to the addictive nature of the dollar menu; is this a criticism of the payment method or the unhealthy, addictive nature of the meal?

How blockchain can enhance BNPL

Now we arrive at the crux of the article – why and how blockchain can upgrade the BNPL experience. The largest benefit to migrating BNPL over to blockchain is the amount of transparency of the full life-cycle of the product. From where the funds come from, to what interest rates are being charged, there is no room for abstraction. As long as the product features are programmed into a smart contract, there are no surprise hidden fees or nefarious actions without the general public’s knowledge. Transparency leads to public scrutiny, which also means the public can participate from either side.

Creditors can come from an individual, all the way up to a large institution that decides to build a loan portfolio. A decentralized platform allows creditors who wish to loan funds to consumers for a reasonable risk-to-reward are now able to do so. Given the nature of smart contracts, it would be possible to group the risk into degrees of credit scores, thus providing full transparency to each loan profile a creditor is extending funds towards. Higher-risk consumers can access finance by paying higher interest rates, and creditors are rightfully matched to the risk reward they seek.

With traditional BNPL systems, the payment process can be complex and involve multiple intermediaries, which can increase the cost and time required to complete a transaction. With blockchain technology, the payment process can be more efficient and cost-effective, as it eliminates the need for intermediaries and allows for direct peer-to-peer transactions. With fewer middlemen to process each transaction and payment, platform providers can easily pass on this cost-saving to consumers.

As for consumers, they now can fully verify why and how their credit is assessed. The current credit scoring system is murky and prone to lots of errors – see the 2017 Equifax hack for reference. By having all loans processed on the blockchain, each wallet can build a credit score from scratch, at a pace they are most comfortable with. Of course, this isn’t limited to just BNPL, as longer-term loans, mortgages, and other credit can be made transparent as well. However, given BNPL’s quicker turnover profile and ease of operation, a consumer can start small with BNPL plans to slowly build up to large loans in the future. This is liberation from the traditional companies gatekeeping the entire credit process in fiat.

The added level of security by migrating over to blockchain would help alleviate the amount of insurance and costs associated with preventing hacks in the current traditional fiat system. Given the immutable nature of smart contracts, most larger-scale protocols go through severe scrutiny before general public access. As Ethereum has been around for close to eight years now, many protocols have been battle-tested, while the OpenZeppelin library provides common functionality that is safe.

This may be a minor point to make now, though in the future the peer-to-peer nature of crypto will allow users to trade with BNPL. Given digital assets can be held in an escrow during the BNPL payment period, such as Cyan’s solution, users can trade with each other with the seller accepting all funds upfront and the buyer making payments over some time. Cyan’s current BNPL platform allows buyers of digital assets to purchase from a marketplace such as OpenSea, which has NFTs (non-fungible tokens) listed by individual sellers. This is a peer-to-peer protocol whether participants realize this or not!

Lastly, we at Cyan believe there will be a major shift toward phygitals shortly. Phygitals are digital versions of real-world items for authentication. A digitized version of an item would make trading and finding liquidity much easier, so long as a trusted custodian is utilized for the real-world item. Currently, phygitals are issued as NFTs, which serve as proof of authentication for the item. Ownership of such an NFT gives the user the right to claim the item when they wish – this digitalization allows for creative ways to provide financing, leverage, bartering, and many other possibilities. BNPL is a prime example of such a use case, where the NFT can be held as collateral until the plan is fully repaid. Cyan provides this service and is accessible today.

Challenges ahead to make BNPL on blockchain a reality

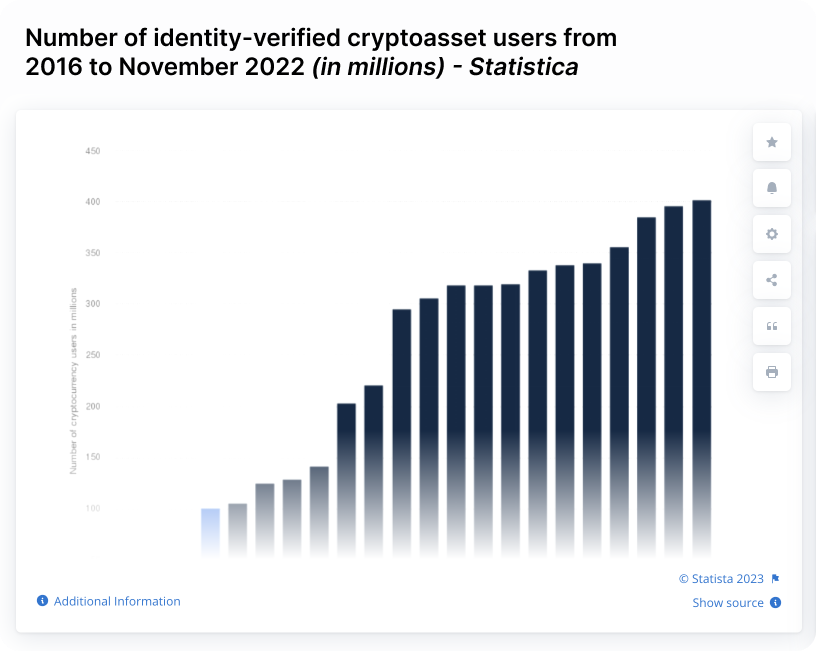

The largest challenge currently isn’t technology, regulatory, or effort-related reasons. User adoption is the greatest challenge in making BNPL on the blockchain a reality. The penetration rate of blockchain so far globally is around 5.6%, or 450 million wallets according to Statistica. While this is an impressive amount of users, Bitcoin has been around for 14 years now and Ethereum for 8 years, compared to Facebook which is 18 years old and has 3 billion users worldwide. It is indeed disingenuous to compare a social media company to a global currency payments network, but the penetration rate of blockchain technology itself is still lacking. As more participants escape to crypto and blockchain from traditional fiat systems, companies like Cyan are ready to provide custody, financing, liquidity, and management of digital assets.

As 2022 has proven to be a disastrous year for centralized blockchain companies, regulators will have an added level of scrutiny to anything living on the blockchain going forward. This may hinder some progress across the industry as many play catch up to the global standards of KYC and AML. Despite this, regulators are pragmatic and understand the limited resources across the industry as it stands and for most start-up projects. There are sandbox and compliance-lenient programs designed to allow crypto companies to grow before full regulatory coverage.

Conclusion

Buy Now, Pay Later is a powerful payment model being utilized today by millions of consumers worldwide. As this becomes more commonplace, users will expect the same level of usability, flexibility, and interfaces on the blockchain as the world ports over to crypto. The added benefits of transparency, ease of payments, higher security, and network effects will become more apparent as BNPL on blockchain take flight in the coming years. Cyan will be here to help pave the road toward a hassle-free financial future.

Resources

CB Insights on BNPL – https://www.cbinsights.com/research/buy-now-pay-later-global-market-map/

BNPL global e-commerce share – https://www.cnbc.com/2021/09/21/how-buy-now-pay-later-became-a-100-billion-industry.html

BNPL market share by Payments Dive – https://www.paymentsdive.com/news/affirm-gains-klarna-slips-in-q3-buy-now-pay-later-payments-bnpl/634100/

Klarna – https://www.klarna.com/us/

Afterpay – https://www.afterpay.com/en-US

Affirm – https://www.affirm.com/

2017 Equifax data breach – https://en.wikipedia.org/wiki/2017_Equifax_data_breach

Statistica worldwide crypto users – https://www.statista.com/statistics/1202503/global-cryptocurrency-user-base/