The NFT markets are changing rapidly. This is partially due to the space being influencer-driven, as narratives are created and fade as quickly as they appear.

Underneath all the noise, legitimate projects are building impressive intellectual property (IP). These projects tend to focus on delivering value to their communities, either through quality content or providing a service that is unanswered in the traditional web.

Let’s explore some possibilities in NFT Markets for 2024 and beyond. But most importantly, do you know how to check the authenticity of a NFT Marketplace.

Table of Contents

Current Trends in the NFT Markets

When talking about NFT collections, there are a few types to keep in mind. The major categories are Art, GameFi, Profile Pictures, Memberships, and IDs. Each category is expanded below.

Art NFTs

These collections are self-explanatory.

Famous digital artists and NFT influencers create new collections to entice buyers to continue building their galleries. Artists such as Beeple continue to put out new work every day and occasionally have sales on a new piece or collection to drive sales.

This category is very hard to follow unless you are chronically online. Most artists post updates on Twitter, thus keeping track of trends on the social platform is critical for participation.

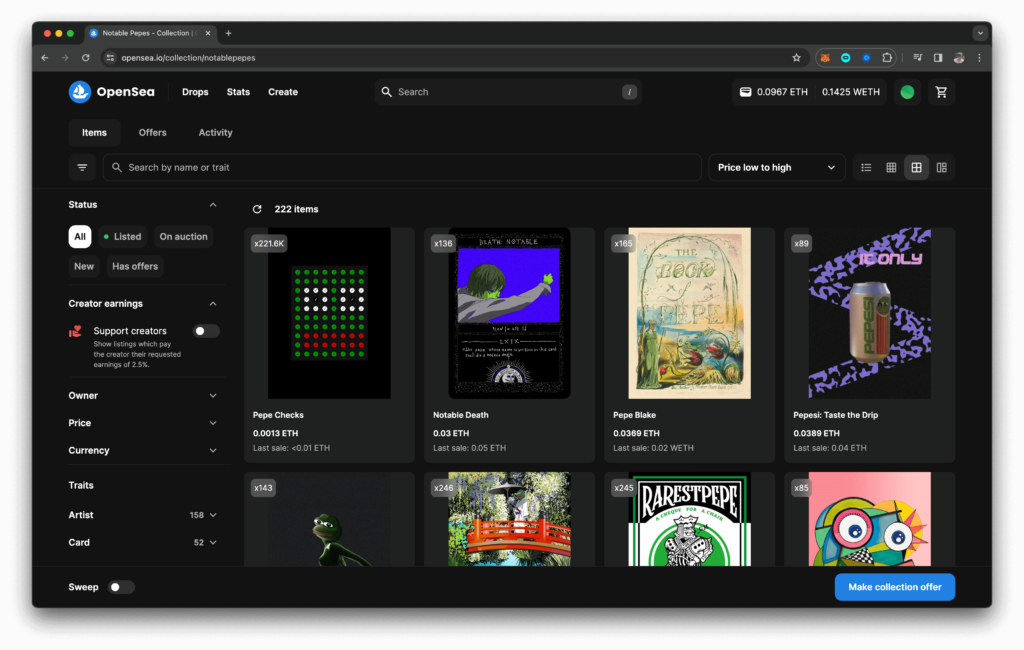

Memes also fit into this category. One famous example is the Pepe, an illustrated frog that has grown in popularity after starting from the infamous 4chan.org boards.

Most memes in the NFT space start from 4chan.org and other internet lore. Unless pieces come from the artists directly, it is hard to pinpoint a value in any meme collection. Virality plays a big part, however, influencers drive the trend and thus price.

The future of NFT art is recently driven in part by artificial intelligence. Collections such as Winds by Yanawanawa incorporate complex algorithms to create beautiful pieces of digital art. This collection in particular is interesting, as it can be displayed on sizes as large as billboards without losing any quality. This is a rare trait as most NFTs are sized to appear on computer screens and mobile devices. In addition to the high fidelity, the artwork also animates to create an entrancing effect on the viewer.

As AI becomes more complex, so will digital artwork. NFTs are a universally accepted method at this point to prove ownership of digital work. Many traditional art collectors are moving into collecting art NFTs, but are stymied by the conversion of fiat to cryptocurrency. As these barriers lower, more collectors can enter and increase the size of the purchase pool.

Explore the Art NFT Marketplace by Cyan.

GameFi NFTs (short for “Gaming Finance”)

NFTs issued by projects building games are a relatively new concept in the space. Larger companies like Yuga Labs have pivoted into being a game and metaverse but originally did not set out to become one. As the global gaming industry is estimated to be around $250B, web3 companies inevitably go down this path.

Did you explore the New Cool NFTs in Cyan’s Gaming NFT Marketplace?

Many projects use NFTs as a way to boost strap funds to build their games. Famous game studios like Zynga have started issuing collections. Zynga’s new gaming project is called Sugartown Oras, which is starting with 9,999 NFTs for future players to purchase. DigiDaigaku is another collection issued with the specific purpose of being a game, led by gaming industry titan Gabriel Leydon.

The future of gaming finance is growing, as new categories are introduced like gamble finance (GambleFi for short). Rollbit is currently the largest cryptocurrency casino, with a feature for users to pawn their NFTs for instant loans. A recently failed example of GambleFi is Friend.Tech, a social network predicated on followers purchasing shares of a content creator and trading these shares as NFTs. While this experiment failed, the model is being polished and forked as other projects.

CryptoKitties is the oldest example of gaming finance, followed by Axie Infinity which exploded in popularity in 2021-2022. Sandbox is an example of a Metaverse which captured a lot of attention but has since fizzled out from its peak in 2022.

In the next bull run, there will inevitably be projects that copy these projects and enjoy the upside of new narratives.

Profile Picture NFTs

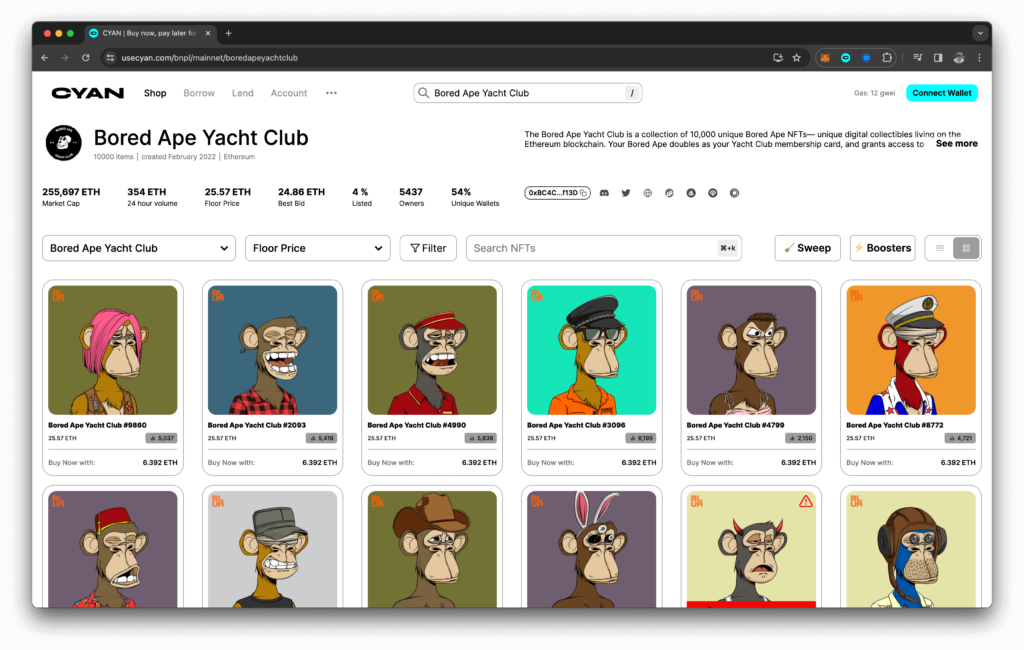

This category of NFTs is what most people are familiar with. The Bored Ape Yacht Club is most likely the most recognized, as many celebrities pushed this collection in 2021. There were thousands of collections issued during the 2021-2022 NFT bull run, but almost all but a handful have perished. Projects owned and run by Yuga Labs are mostly surviving, with a few outside including Pudgy Penguins managing to keep attention.

Profile picture NFTs mostly live on revenues generated by secondary trading. Trading royalties were enforced up until the marketplace Blur was launched in October of 2022. These royalties kept these projects well-fed with revenue, but once they were flattened to zero, the main source of cash flow was eliminated. This forced many projects to pivot into GameFi or more ambitious Metaverse projects.

Soon, these types of projects will have a hard time building new communities as the memory of failed collections is still fresh. Projects will likely have to give a concrete roadmap and path to profitability to be taken seriously by venture capital. Otherwise, a strong narrative is required to build hype into any new issuance. The half-life of an NFT hype cycle is tightening with every collection launched, so influencers will have to provide more than just hyperbole to build something legitimate.

Membership NFTs

This subsector of NFTs is community-based. One infamous membership NFT was Trait Sniper, which was a tool used in the space to shop for new NFT collections back in the 2021-2022 NFT bull run. As aggregator tools like Gems and new marketplaces like Blur launched, it made Trait Sniper redundant and eventually users left the platform. Users had to purchase the Trait Sniper NFT to access more features in their application.

Explore the Membership NFTs Markteplace by Cyan

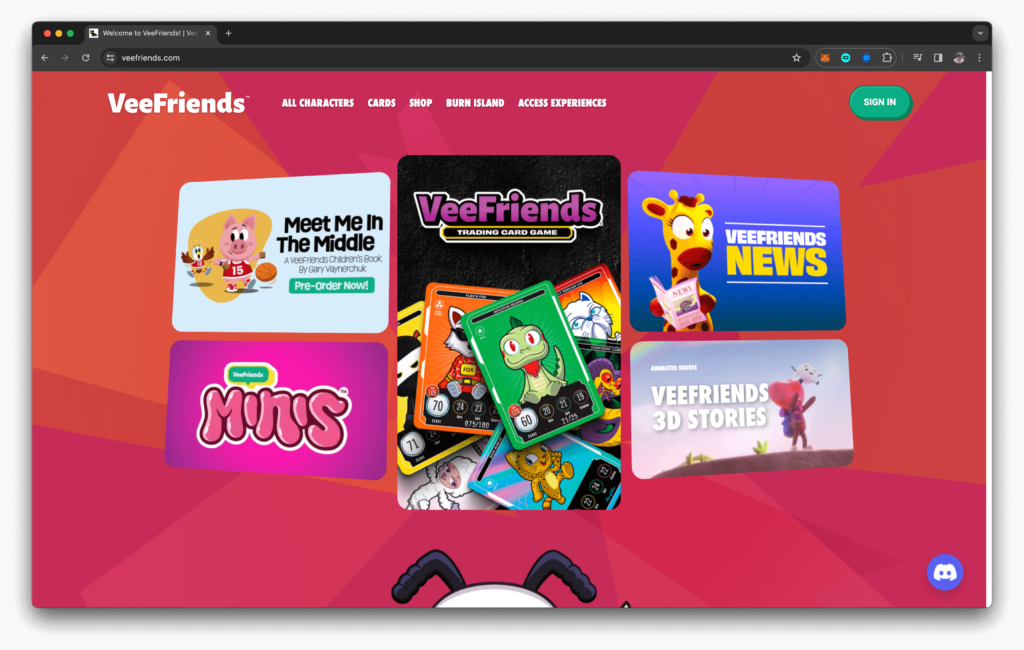

Similar tools still exist today, and new ones are created to try to fill a niche. There are hundreds of failed tools, with communities now left with useless membership NFTs to show for. Membership NFTs aren’t limited to tools, however. Some NFTs were purchased for the exclusive rights to attend a conference. Gary Vaynerchuck’s VeeFriends is one such collection, with NFTs valued purely on their access to VeeCon and other perks. Proof is another membership NFT which gave access to exclusive conferences. Proof has been discontinued as of early 2023, and its NFTs have no value now.

This category of NFTs is hard to value as the experiences offered are hard to quantify. In general, any membership you have to purchase to be a part of is not worth the value. Costco is perhaps the only example of a valuable membership, though it’d be hard to imagine their executive board is getting excited to issue NFTs.

Identity NFTs

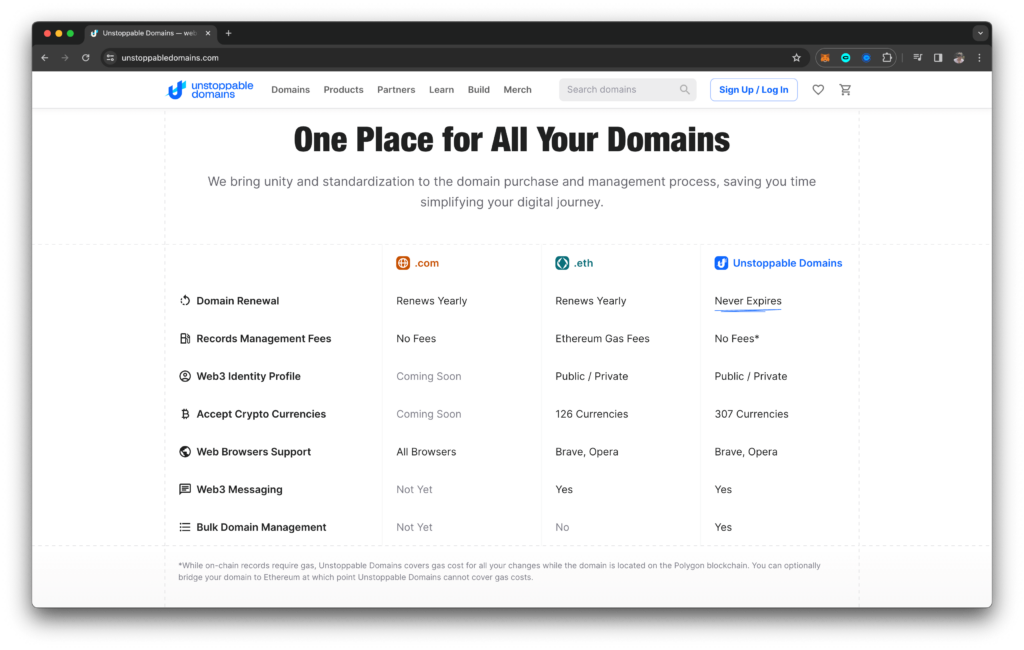

This last category of NFTs has some use cases in the real world. Lens Protocol, Unstoppable Domains, and Ethereum Name Service (ENS) are some examples of existing IDs. The idea is to purchase one NFT that serves as your public handle in both web2 and web3. Unstoppable Domain NFTs can be used as both a username and a website domain, though only accessible on the Brave browser.

Outside of ENS, which has the “.eth” handle, ID NFTs haven’t caught on within the crypto community. It’s partly due to a lack of narrative around them, and the sheer number of IDs available as they are essentially handle names. Picking up a few names you enjoy is a worthy price to pay as they are generally cheap outside of the obvious squatting names – those that are company names, famous people, and other “.com” like equivalents.

Data Shows the Revival of NFT Markets

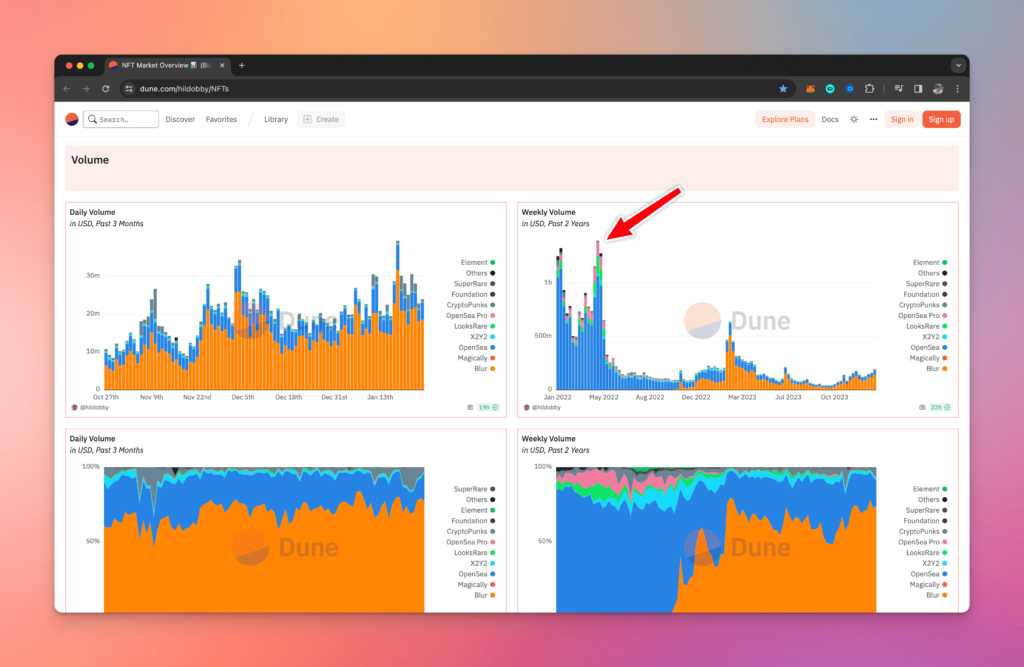

Recently, the floor prices of certain collections have started to gain traction. Pudgy Penguins are now worth 19 ETH, getting close to the leading collection Bored Ape Yacht Club of 26 ETH. However, when looked at holistically, the market has not recovered as total volumes are still considerably lower than the average seen in 2022 and 2023.

The weekly volume peak of 2023 was in the week of February 20th, with $640 million in total turnover. Compare this to the $170 million weekly peak for 2024 so far. For reference, the peak in 2022 was $1.4 billion in the week of April 25th. NFT markets in 2024 are still close to ten times smaller than those of 2022, signifying participants haven’t fully returned.

However, this shouldn’t be taken as all gloom and doom. With the recent Bitcoin ETF approval by the SEC and the upcoming Bitcoin halving, it is widely expected volumes will return in cryptocurrency. Once traders profit in tokens, there is usually a carryover to NFTs as those profits are used to purchase NFTs to ‘flex’ with. New narratives are created, along with new hyped-up projects that create momentum.

Future Applications of NFTs

As NFTs mature, applications of the technology may emerge in the traditional economy. NFT technology has been around since 2017 since the initial launch of CryptoPunks. The most recent trend has been to apply NFT technology to real-world assets, otherwise shortened to RWAs. Given the non-fungible nature of these tokens, they are a fit for fixed-income products.

Companies like Goldfinch are working towards decentralizing the funding process for small to medium-sized businesses globally. Factoring, short-term loans, and debt aren’t as easily accessible by companies located in developing countries. Tokenizing this debt as NFTs opens up the possibility for investors globally to participate.

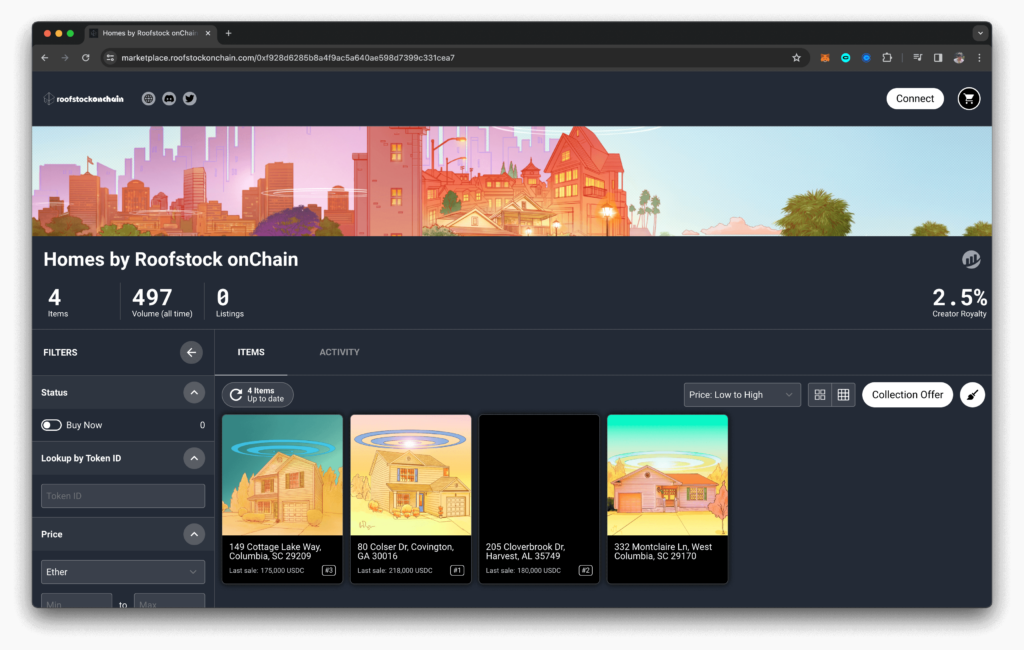

NFTs can also be applied to real assets such as houses and cars. Projects like Roofstock are issuing NFTs on real housing to procure yield to investors. A user can buy the NFT to collect a part of the cash flow generated from renting houses in California. Cyan has also explored the possibility of creating NFT loans for cars, which would allow borrowers to use their cars while they pay loans back in ETH or USDC. Loans would be collateralized by an NFT backing a car.

What Makes an NFT a Good Investment?

There is no sure rule for determining what is a good NFT investment. In the end, all financial common sense should be applied before deploying any capital into NFTs. Here are some things to look for before making any purchase:

- How long has the project or company been around?

- Who is on the team? Are they doxxed, or are they well-known already in the crypto community? You want people who are putting reputations at risk to generate profit.

- Is what they are building proprietary?

- Is what they are building easily replicable? Art can be copied by AI these days, so the project needs to have more purpose to generate proper revenue

- How is the project or company going to grow?

- Is the growth sustainable without Twitter ‘narratives’ and hype?

- Does the team have any track record?

- Are you comfortable with their cap table? Does it heavily lean either towards VC or influencers? Does the mixture of investors make sense, or is it for vanity?

These guidelines are for trying to assess whether a project is worth putting any money towards for the longer term and comes from my years of experience in the NFT markets.

Also note that much of NFTs and crypto are myopic, so this strategy is not necessarily condemned for making quick bets. In that case, you are better off following narratives and hype on Twitter. However, be warned, by the time you catch a hype tweet, it’s already being liquidated by the originators of the hype.

Don’t be the exit liquidity.