Art oriented NFTs have emerged preferred asset for both collectors, arbitrageurs and investors. The demand for NFTs have been so high in recent times that some of them were sold in millions of dollars.

But what drives individuals to shell out astonishing sums for digital art? Passion, profits or showoff?

Let’s dive into an exploration of the factors fueling these purchases. Lastly, as an example, we will also be taking a closer look at the monumental sale of Beeple’s “Everydays” that was once sold in $69 million.

Table of Contents

1. Demand and Supply

Just like in the traditional art world, the law of demand and supply is a fundamental principle at play in the NFT marketplace.

The more unique or desirable an NFT is, coupled with a limited supply, the higher the price it can command. This basic economic principle underpins much of the frenzy around art NFTs. Collectors are always on the lookout for pieces that not only resonate on a personal level but also hold the promise of exclusivity.

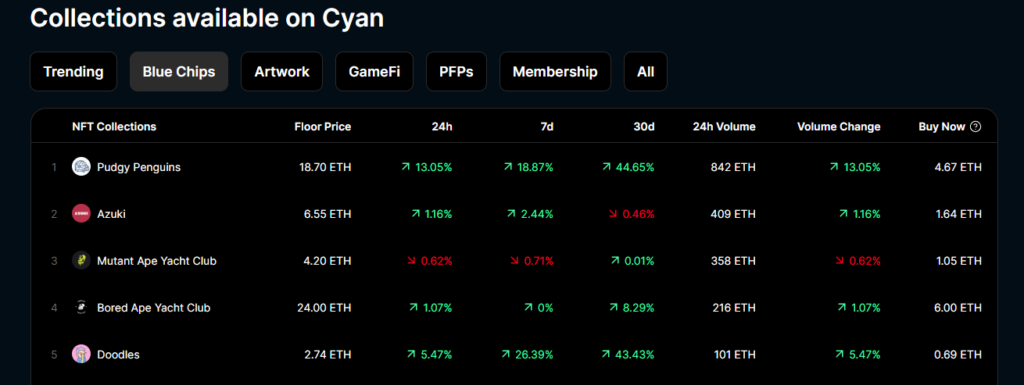

Popularity of the NFT creator adds to its demand. Popular NFT creators like Pudgy Penguins, Doodles and Yuga Labs (BAYC) often sell NFTs in the most premium price range.

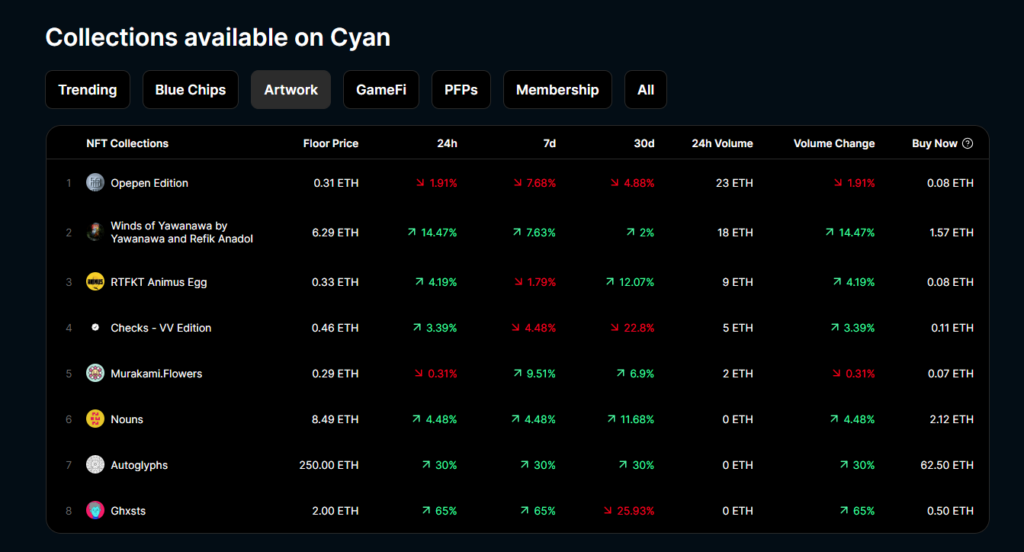

These are called as Blue Chip NFTs. Here are a few examples from CYAN’s Marketplace.

2. Profiting from Market Trends

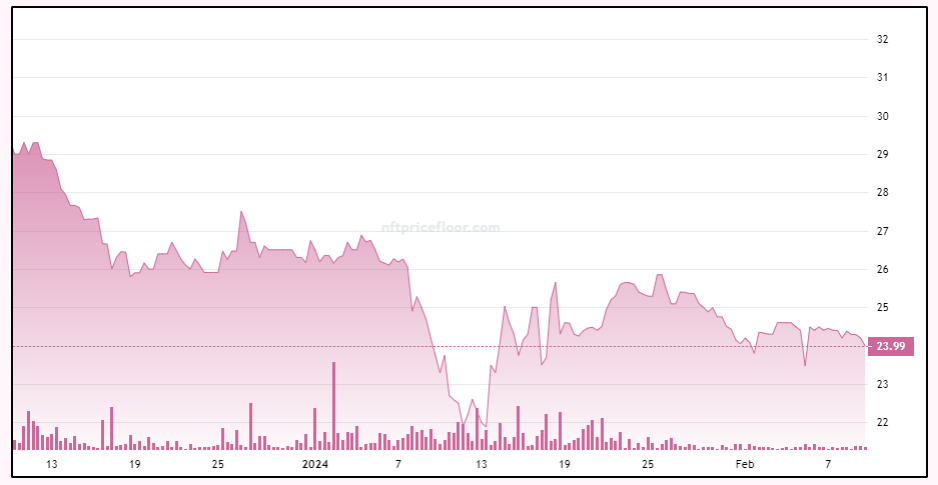

Investors in the NFT space often adopt a strategy familiar to stock market enthusiasts: buy low, sell high. During bear markets, when prices are generally lower, savvy buyers scoop up art NFTs. They then wait for bull rallies, when optimism and spending in the market increase, to sell their holdings at a profit.

However, its much harder than it seems. This cyclical strategy requires patience and a keen eye for market trends. And therefore has been a proven method for only a few to capitalize on their digital art investments.

During the time of investment, often markets are in a very bad sentimental phase. Any investment during such phase might also result in a total loss.

3. The Rarity Factor: Beeple’s “Everydays” as a Case Study

One of the most compelling draws of art NFTs is their rarity. Beeple’s “Everydays: The First 5000 Days” is a quintessential example, fetching an eye-watering $69 million at a Christie’s auction. This digital collage, comprising 5,000 individual images created daily over nearly 14 years, exemplifies how scarcity and the artist’s reputation can elevate an NFT’s value. The sale underscored the premium that collectors are willing to pay for pieces that are not just rare but also carry a significant narrative and historical value.

Identifying a Rare NFT

So, how does one identify a rare NFT? Here are some detailed pointers:

- Artist Reputation: Renowned artists or creators tend to produce highly sought-after works. An NFT by a well-known artist or one who has a significant following can be considered rare.

- Limited Editions: The fewer copies of an NFT available, the rarer it is. Look for limited edition series or one-of-a-kind pieces.

- Provenance and History: NFTs with a unique story or that mark a significant moment in the digital art movement are often deemed more valuable.

- Utility and Rights: NFTs that offer additional benefits, like exclusive access to events or rights to physical items, can also be seen as rare due to the added value they provide.

- Community and Social Proof: Works that have garnered attention and acclaim within the NFT community or have been featured in reputable galleries or exhibitions are often good indicators of rarity.