Staking is the process of locking your cryptocurrencies (or NFTs) to receive rewards. The process is used by proof of stake blockchains, which rely on stakers, to secure the chain.

The process usually involves holding funds in a cryptocurrency wallet to support the operations of a blockchain network. Usually, those who stake coins do so in the name of a validator who verifies blockchain transactions. The higher the number of stake coins the validator has, the higher his authority and the higher the transactions they will get to validate.

Table of Contents

Different Ways to Stake

Users can choose any of the below ways to stake their crypto or NFTs.

Direct

This involves participating directly in the blockchain by running a full node. It requires considerable technical knowledge and sometimes a significant minimum amount of crypto (stake).

In Ethereum, this minimum amount is 32 ETH and it allows the users to become a validator and earn fees for verifying transactions. However, staking is not limited to Ethereum alone.

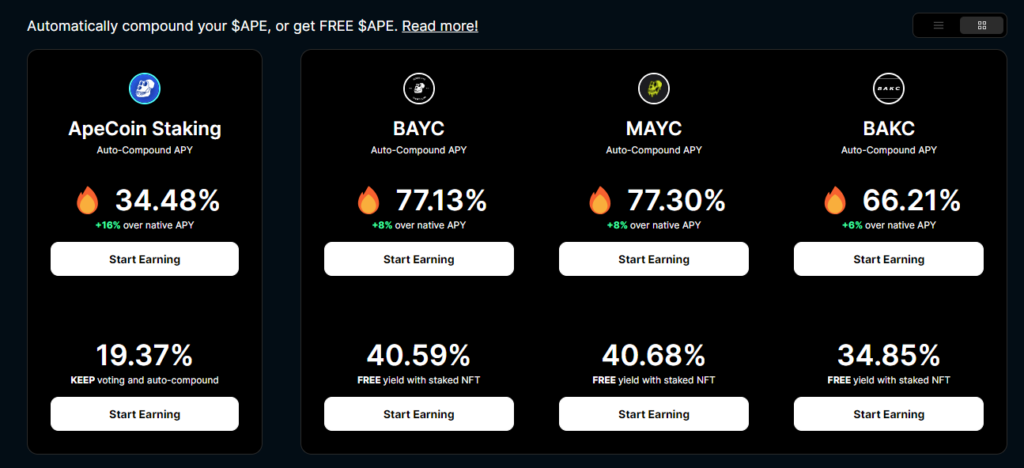

You can also stake other cryptos that follow a proof of stake consensus mechanism. ApeCoin Staking by Cyan allows you to stake both NFTs and crypto which get you as much as 77.3% in annual yields (APY).

Pools

For those unable to meet the requirements of direct staking, there are some pools that aggregate the resources of multiple stakeholders, enhancing their chances of receiving rewards.

The pools collect resources from several users and combine them to stake in a protocol. The benefits are nearly the same except for a small fee which is charged by the pool operator. Since most of the data is on-chain, these pools are mostly safe.

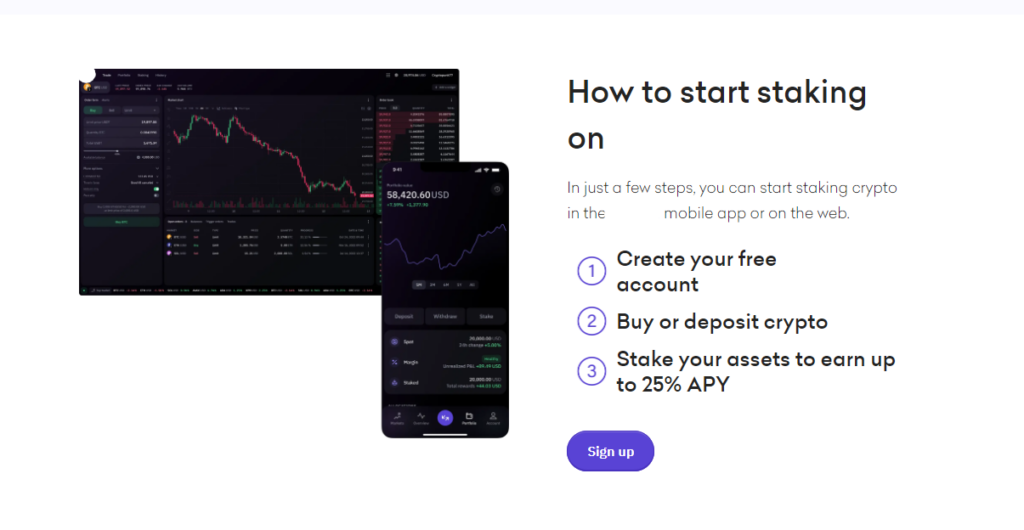

Exchanges

Many cryptocurrency exchanges offer similar services, allowing users to stake their coins within the platform. It’s user-friendly but involves trusting your coins to a third party.

Exchange staking operates on a similar level as pool operators, except for the fact that they have much larger access to funds. Exchanges are also easily approachable in case any user faces any problem.

A drawback of exchange staking is that usually the fees are higher and hence it impacts the returns on investment. For example, for the same ApeCoin, an exchange gives you 25% APY while at Cyan is 34.5% APY.

Delegated

Users can delegate their coins to a validator (a party responsible for running the node), who stakes on their behalf, sharing the rewards. This type of staking usually takes place through wallets such as MetaMask or Trust. The crypto never leaves your wallet but is locked for a period.

Benefits

Rewards

Stakers earn additional coins as rewards for their contributions to the network, which can be a steady income stream.

Rewards also called Yields, vary from chain to chain and also from time to time. On Ethereum, you can get an APY of around 4% while on Apecoin it gives about 35% APY.

Network Security

Staking contributes to the security and efficacy of the blockchain, helping to maintain the network’s integrity.

There are huge rewards associated with staking with the correct protocol. For example, in our example of ApeCoin, staking from Cyan also lets you participate in Governance where you can vote on proposals and control the future of the entire ApeCoin ecosystem.

Risks

We found in our experience that these are the most serious risks.

Liquidity Risk

Staked assets are locked and cannot be sold or exchanged, leading to liquidity issues, especially if the market moves unfavorably.

Slashing Risks

In some networks, validators can be penalized for misbehavior or downtime, risking a portion of the staked amount. This increases the risk of penalty for you, someone who did not do anything.

Hence, wherever possible, please carry a due diligence to assess if the validator where you are about to stake has any bad history.

Market Risk

The staked cryptocurrency might depreciate, which could lead to losses despite earning staking rewards. Since most cryptocurrencies are highly volatile, staking is for those who have a long-term view of the crypto. Also, steady hands turn to make the most profits if the cryptocurrency has been selected carefully.

Complexity

Properly managing staking, especially in a direct capacity, can be complex and requires a good understanding of the blockchain technology involved.

If you are troubled by the complexity, we recommend you go through our protocol which we believe is the most simplified way to stake ApeCoin.

Terms That are Mistaken

Yield Farming

Yield farming is the process of maximizing the returns on your crypto by staking for short terms by moving your crypto between different protocols for a higher APY. Although a very time-consuming and highly arduous effort, it gives the maximum returns.

A small drawback is the increase in transaction fees as you rapidly move between different protocols.

Crypto Lending

Lending crypto is the act of transferring your funds to others for a return (interest). Usually, lending works with collateral. For example, if you want to take a Bitcoin loan, you could offer your USDC as collateral. When the price of Bitcoin rises, you sell it to make a profit and redeem back your USDC with the rest of the funds.

However, there is a risk of bankruptcy if the collateral is itself volatile.

Conclusion

Staking is a cornerstone of the PoS blockchain ecosystems, offering participants a way to earn passive income while contributing to network security. Therefore, it’s crucial to understand the different methods, along with their inherent benefits and risks.

Comparing staking with other investment strategies like yield farming and crypto lending helps investors make informed decisions based on their risk tolerance, investment horizon, and involvement level they desire in the crypto ecosystem.

As with any investment, thorough research and a clear understanding of the associated risks and rewards are paramount. Else you will either lose high returns or risk losing your portfolio itself.

Frequently Asked Questions

Is staking better than crypto earn?

Yes because exchanges use your funds to stake or lend crypto to others. Any income you get with “earn” will be lesser as exchanges take their cut.

What is the best crypto to stake?

For someone who is paranoid about safety, Ethereum is the best. For others who want to earn a little extra, Apecoin is good choice.

Is it worth to stake Ethereum?

No, it is not. Because Ethereum staking is overcrowded. You can earn more with simply staking other popular coins like MATIC, ApeCoin or Cardano.

Is staking the same as lending for interest?

No, your income comes from a portion of transaction fees and by minting new crypto. In crypto lending, your income comes from charging a direct interest. Staking yields vary but interest remains the same.

Can you get rich crypto staking?

Yes and No. To get rich by staking, you would have to take millions of dollars as debt, buy crypto, stake it, and hope for a stable or bull market. You also need to make sure yields are higher than your interest payments. If you can do this, yes you can get rich, otherwise no.

Can you withdraw crypto staked?

Yes, you can withdraw crypto which is staked. But, you might lose your accumulated staking rewards.

Which coin has the highest staking reward?

Among large-cap coins, ApeCoin has one of the highest rewards at 35%.

Is crypto staking taxable?

Yes, it is assumed as income and taxed accordingly. However, there are no clear laws for such returns in even major countries.

What happens when you unstake crypto?

When you unstake crypto, your staking period ends and all coins are open for you to transfer or sell. If you unstake at the end of the staking period, you get the rewards, otherwise, you might lose the accumulated rewards.